Are you starting a fundraise soon? Here are three great tools that will help you close your round faster…

Fast Round. It’s way easier to get a check from a warm intro than a cold message. What if you could get dozens or even hundreds of warm intros all at once?

Ryan Hoover just dropped a great tool called Fast Round. It lets you see every investor who follows you on Twitter. Then, you can DM them and set up a time to meet.

I typed my handle in and found 149 investors that follow me. I had no idea it was so many!

This tool alone could take you from zero dollars committed to closing your round.

OpenVC. OpenVC is a platform to connect founders and investors. Just browse and pick who you want to meet.

I’ve sourced two deals on OpenVC so far. It’s performed so well for me I’m on there multiple times a week, including just a few minutes ago!

The platform is straightforward and easy to use. You’ll find many top funds there.

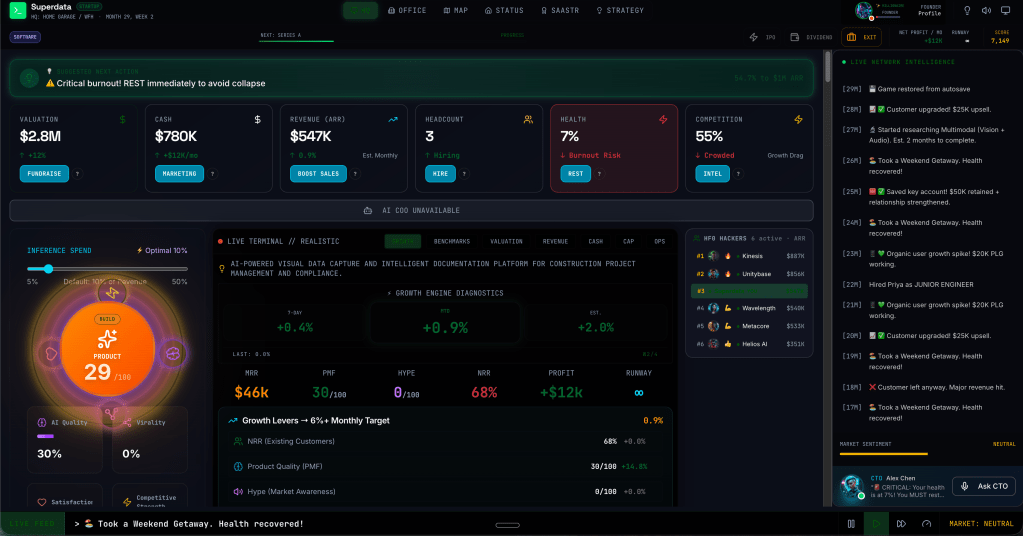

Founderscape. Founderscape is a game created by Jason Lemkin that lets you simulate running a startup.

Founderscape lets you build products, hire teams, and raise money. I just played this morning and almost ran my startup into the ground!

I kept pushing to sell more without hiring. Founderscape repeatedly warned me that I would soon burn out.

I’m sure this happens to a lot of real founders!

Founderscape is a lot of fun. It’s also a great way to experience the trade-offs that come with running a company.

Spend a few minutes playing this game, and I’m sure you’ll learn some things that help you at your startup. For me, Founderscape reminded me of the value of rest.

Wrap-Up

Years ago, if you wanted to raise money for your startup, you had to know someone. Today, there’s tons of tools to help you.

Try using Fast Round and OpenVC to find some great investors. And when you’re ready to destress and learn at the same time, pop open Founderscape!

What are your favorite fundraising tools?

More on tech:

Stop Trying to Change Investors’ Minds

Meet My Latest Investment: Cortex AI

Request for Startups: Construction AI, Cybersecurity and More!

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.