Every pre-revenue startup is raising at $30-40 million right now. Making money on these bets will be next to impossible.

A year or two ago, a company with little or no revenue might have raised at a $10 million cap. Not anymore.

The price is going to be over $30 million. That cuts your upside by 2/3rds.

The Math Doesn’t Math

Here’s how I think about entry price…

The bulk of your returns usually come from a single investment. In my “fund,” I have 35 primary investments.

I need to 4x the fund to make the risk and illiquidity worthwhile. That means one of these little companies needs to go 140x.

But wait…even 140 isn’t enough.

If you’re investing at pre-seed and seed like I do, you typically lose 1/2 your gains to dilution. After all, the founder needs to raise a lot more money along the way.

So that 140x becomes 280x. Round it up to an even 300.

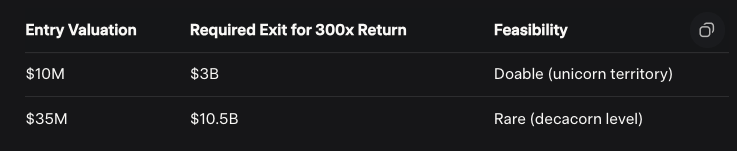

If I get in at a $10m cap, I need the company to hit a $3 billion valuation for the math to work. This isn’t easy, but it’s doable.

But if my entry price is $35 million, this little startup has to exit for $10.5 billion minimum. That is a very tall order.

There are not a lot of decacorns out there. It happens, but it’s rare enough that I cannot underwrite to it.

Looking In the Discard Pile

If you’re investing in B2B AI agent startups in San Francisco, everything is fully priced. Some of those companies will become huge successes, but the chance of success is already priced in.

You’ll struggle to beat the NASDAQ, and that’s after 10-15 years of illiquidity. An investment like that is not worth making.

So the place to look is in the discard pile…

I found two awesome investments this week. But they’re not in hot areas.

The first is a social media startup. Remember social media?

The second is a robotics company based not in SF but in Connecticut. Mercifully, the plague of high valuations hasn’t yet reached the East Coast.

I’m also excited about an area most investors truly hate right now: biotech.

Many public biotechs are trading below their cash in the bank. And private biotech startups are the furthest thing from hot.

But there are amazing things happening: robotic scientific research, AI models like Evo 2 and State that can help us discover new drugs.

In 5-10 years, biotech could be as hot as AI agents are now. I hope to scoop up some of the best startups before everyone else comes knocking.

I’m also interested in categories that don’t even really exist yet, like cognitive security or CogSec.

CogSec is security for our brains. Sounds crazy, right?

But patients already have brain-computer interfaces like Neuralink connected to the internet. Anything connected to the internet will be hacked eventually.

The time to build and invest in those tools is now, not after a catastrophic breach.

Wrap-Up

“You cannot lose if you do not play.”

That was Marla Daniels, a character in The Wire, one of my favorite shows. She was talking about the Baltimore Police Department. But it’s equally true in startups.

Just because everyone else is investing in AI agents in the same 4 block area of SF doesn’t mean you have to. There are amazing opportunities elsewhere.

There’s nothing wrong with dipping into that crowded pool once in a while when I see something exceptional. But the rest of the time, you’ll find me on a placid lake, fishing for the startups no one else wants.

Have a great weekend, everybody!

More on tech:

Are Hackers After Your Brain? — The Rise of CogSec

Is Biotech Having its ChatGPT Moment?

Where I’m Most Excited About Investing Now

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.

Leave a reply to Why We Should Be Grateful for 10 Year Lockups – Tremendous Cancel reply