My buddy Jesse is raising $600,000. He just sent me his deck and asked me to tear it apart in public. You’re a brave man, Jesse! Let’s get started…

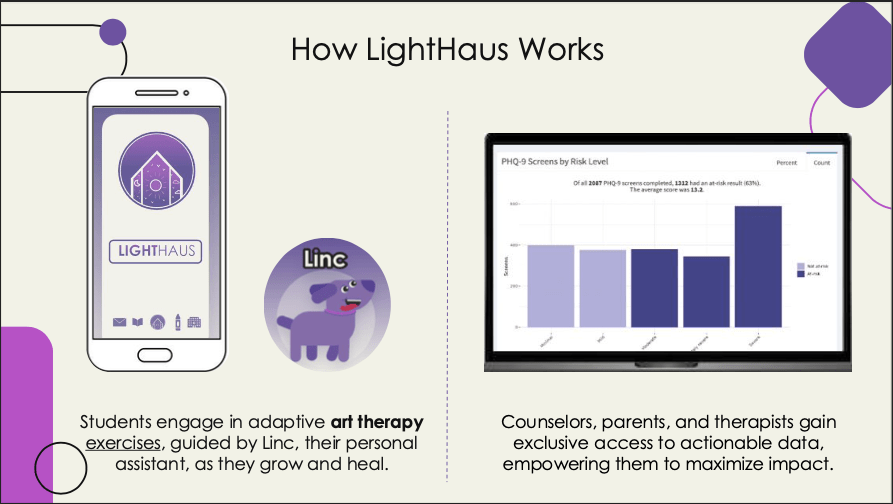

Jesse’s startup is called LightHaus. It’s an app to provide kids with art therapy.

Jesse asked me to be brutal. But honestly, this is better than 90% of the decks I look at.

Let’s look at what Jesse did right and where he can improve…

The Good

Right away, Jesse makes it clear what the company does. Lighthaus is an app that provides art therapy to kids.

I cannot tell you how many decks I read through and still have no clue what the company does 20 slides later. That means the deck has failed completely.

Not only is Jesse clear, he’s also concise, keeping his deck to just 12 slides. That’s a good length to aim for.

I also love that he made the “Team” slide the 2nd slide in the deck.

Especially in early stage companies, I’m betting on the team above all. So I want to know who they are right away!

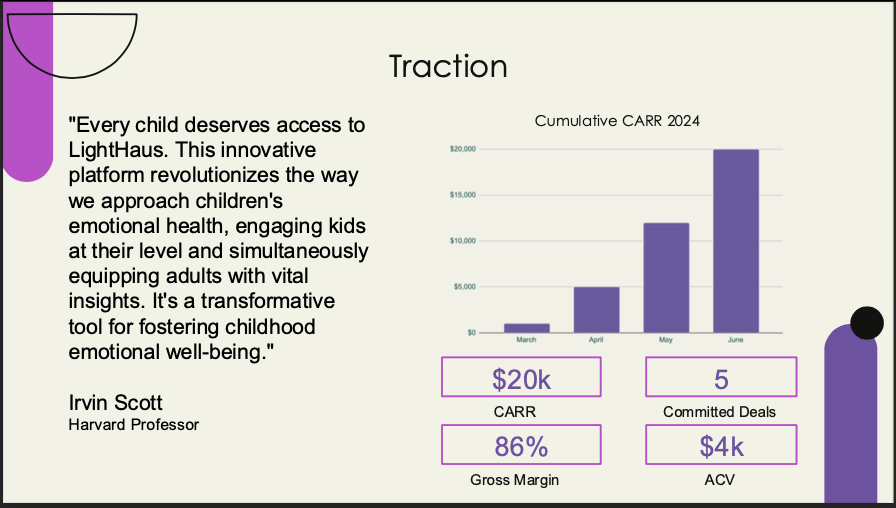

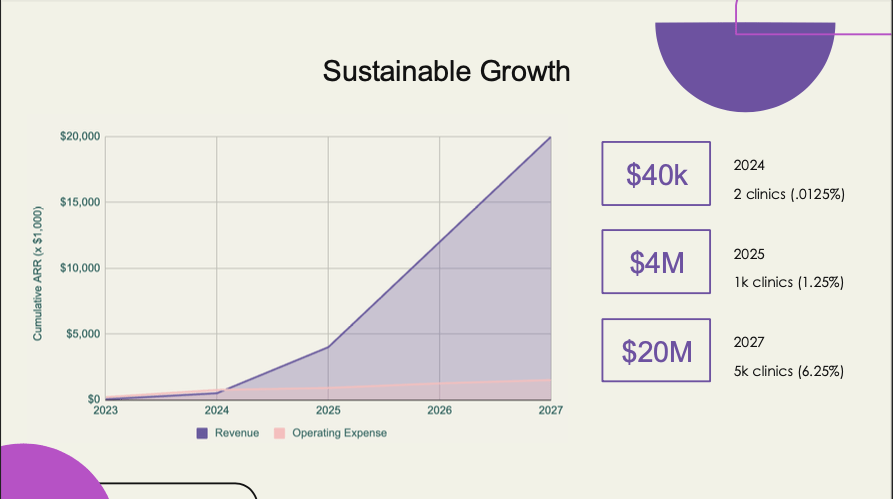

Jesse also shows clear traction. LightHaus’s revenue is growing really fast!

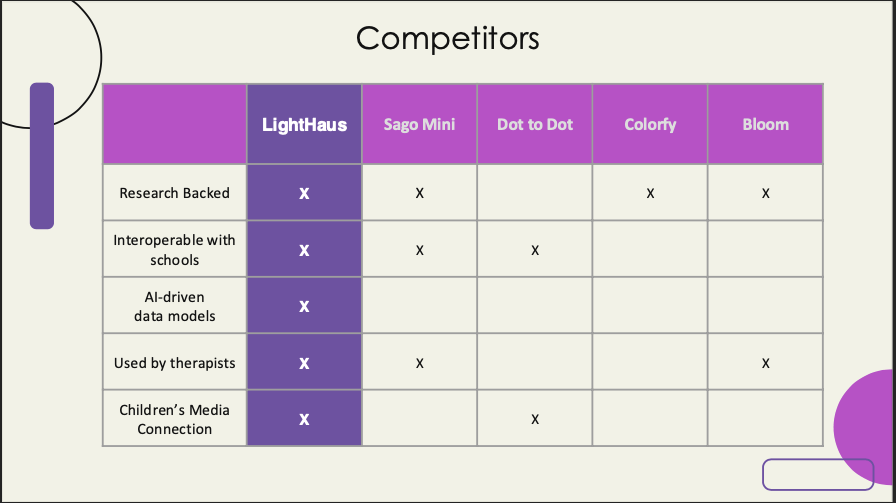

In all, Jesse hits every important point in this deck: vision, team, traction, competitors, TAM and ask.

The Bad

Right on the first slide, I see a big problem: “A product of Mr Bray Labs, LLC.”

If you want to raise money, your startup cannot be an LLC. I wrote a detailed post recently on why.

But fortunately for Jesse, this is an easy problem to fix. Any lawyer familiar with startups can convert you.

There’s a 2nd red flag in this deck: Jesse appears to be a solo founder. I’ve backed solo founders before, but only rarely.

VC’s usually look for 2-4 co-founders. If Jesse had a co-founder (preferably someone technical), he’d raise money much more easily.

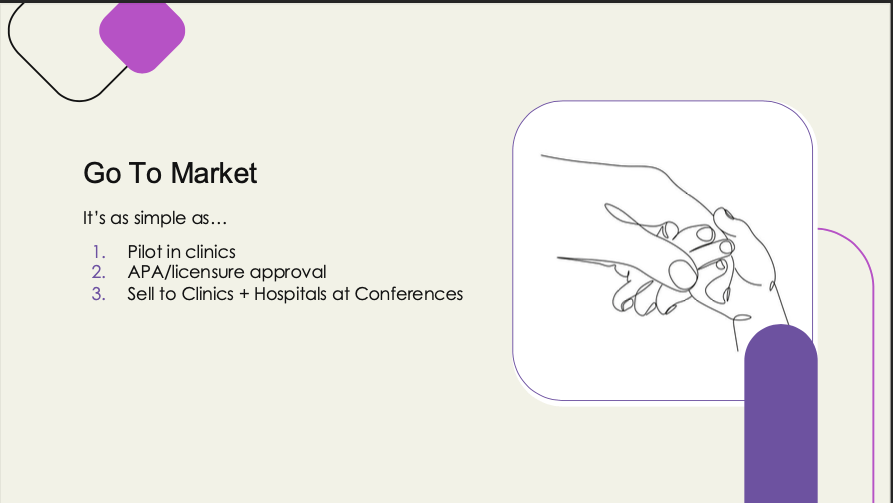

I also found the “Go to Market” slide confusing.

Jesse mentions “APA/licensure approval.” Does that mean the American Psychological Association has to approve this before we can move from pilots to annual contracts?

Many investors aren’t familiar with professional body approvals. So, it would be good to include a little more detail there.

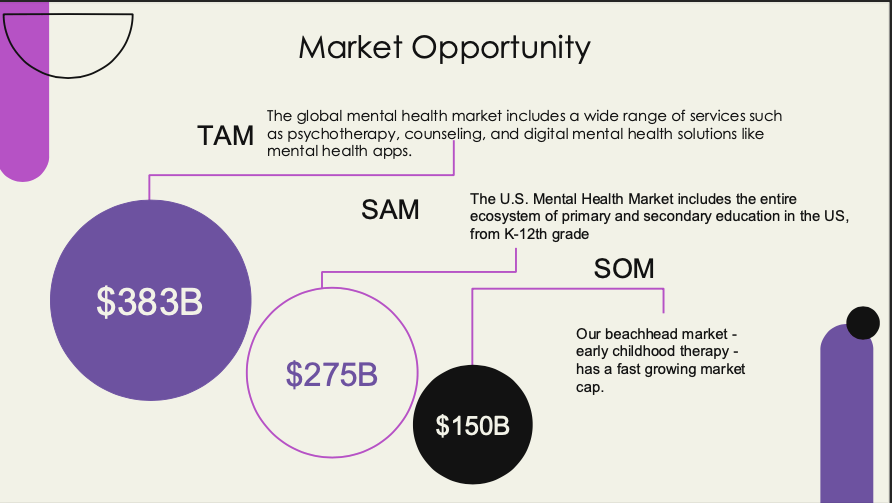

Finally, the TAM slide is incorrect.

What you want to do is calculate a bottoms-up TAM. What do you charge for your product, and how many potential customers are there?

For example, if there are 5 million children who need art therapy and the product is $20/month, the bottoms-up TAM would be $1.2 billion.

I would skip the SAM/SOM stuff. I never look at that anyway — a bottoms-up TAM should be enough.

Wrap-Up

Overall, Jesse’s deck is excellent.

It’s clear and it’s short. That’s what you want to aim for.

If Jesse found a co-founder, converted to a C Corp, and fixed that TAM slide, he’d be in a very strong position to raise $500,000 to $1 million.

What do you think of Jesse’s deck?

I hope you enjoyed this respite from all the election coverage! Whatever happens, we have work to do!

More on tech:

Why Your Startup Must Be a Delaware C Corp

The Big 3: Vision, Team and Traction

Meet My Latest Investment: PodcastAI

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.

Leave a reply to YC’s New Request for Startups – Tremendous Cancel reply