Trump’s new tariffs are making headlines. But a less noticed trend could be a lot more important: a recent fall in interest rates.

Tariffs raise the cost of imported goods. Interest rates determine what we pay to borrow for a home, auto, or credit card loan.

For most startups, the positive effect of lower interest rates will matter more than the negative impact of tariffs.

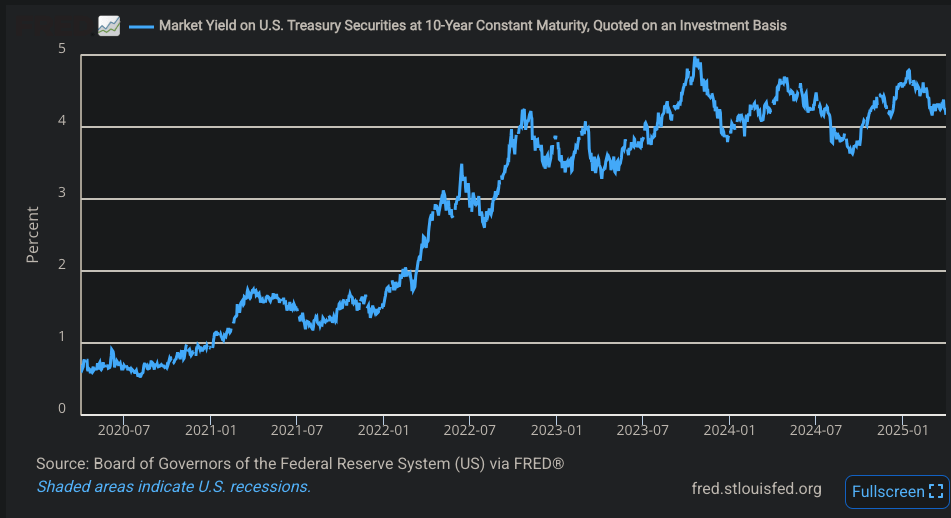

A Broad Fall in Interest Rates

The 10 year Treasury bond rate has fallen from a recent high of 4.79% in mid-January to 4.17% today. This rate serves as the benchmark for mortgages.

Other rates are down as well. The prime rate is down from 8% to 7.5% in the last few months. The 5 year Treasury rate has fallen around 70 basis points. These rates drive the cost of auto and credit card loans.

Rates Matter More Than Tariffs For Most Startups

Tariffs will have little effect on most software startups. They don’t import anything to make their product. But lower rates will help many companies.

For prop tech startups, lower rates are a godsend. The 10 year Treasury is so important to this market that a CRE broker friend of mine checks it every day. Those lower mortgage rates make people much more likely to buy a house.

Similarly, lower rates for car loans help startups in the auto sales sector. And a lower prime rate should be great for fintech startups generally.

Even for hardware startups, the impact of tariffs should be limited.

Most make their product here in America. Their main concern will be an increase in the cost of some components, which may be sourced abroad.

Wrap-Up

My hope is that Trump uses these tariffs as a negotiating tool to get us better terms of trade with other countries. If tariffs help us sell more to the rest of the world in the long term, they could be a net positive.

But if the tariffs stay on for too long, they could be a drag on economic growth. We should use tariffs as a tool, not an end in themselves.

More on markets:

Using Grok 3 to Manage My Stock Portfolio

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.

Leave a reply to Markets Are Overreacting to Tariffs – Tremendous Cancel reply