Note: This is NOT investment advice.

I see Hyundai cars everywhere. But the stock has been left for dead. 4 PE. And it’s not alone…

These days, everyone wants to own the Mag 7. And they don’t want to own much else.

Let’s take a tour of some old economy stocks and see how the markets are treating them.

Autos: Priced for Extinction

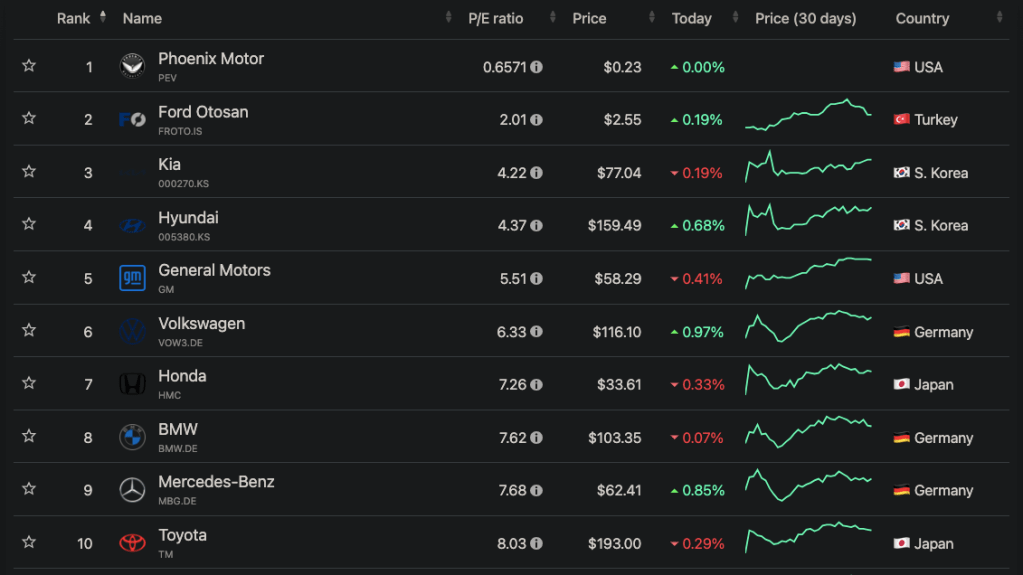

It doesn’t get more classically industrial than this. And unless you’re Tesla, in 2025 your car company is worth bupkus.

The long term average PE for the S&P 500 as a whole is 16. But most car makers are trading far below that.

General Motors is trading at a 6 PE. GM has just 1/75th the market cap of NVIDIA, the most valuable company in the world. This despite GM having slightly more revenue!

I’m not saying GM should be worth what NVIDIA is. NVIDIA’s business has much higher margins and more growth potential.

But does a 6 PE make sense?

Just about every other auto stock shares GM’s malaise. Kia is at a 4 PE. VW is at 6. Even Toyota gets just an 8.

The market is pricing auto makers as if they have a few more years to make money before they disappear.

Auto technology is changing, to be sure. But is the picture really that dire?

Mining: The Foundation of Tech

Okay, maybe old school auto makers are a special case. Let’s try another industry. Something totally different.

How about mining?

Surely there are some bright prospects there! Everyone’s talking about how minerals are so important to electronics.

And yet, many major mining stocks are in the toilet.

Take Vale in Brazil. It’s the 14th largest miner in the world by market cap. And it sells at a mere 5 times earnings.

Political risk in Brazil, I know, I know. But then how do you explain Fortescue, a major miner from Australia? It’s selling at just 6 times earnings.

The picture for miners is slightly better than for automakers. But these stocks are still largely ignored.

Communications: The Overlooked Backbone

Let’s move a bit outside industrials. How about telecoms, one of the backbones of a modern economy?

Comcast provides TV and internet across much of America. And if Comcast isn’t in your area, Charter probably is.

Comcast and Charter have tens of millions of customers each. And they sell for PE ratios of 8 and 7 respectively.

The Mag 7 and the S&P 493

For any one of these old school companies, you could find risk factors.

Risk of replacement by Tesla and BYD for Hyundai. Political risk for Vale. Starlink for Comcast.

But look at the overall picture.

The Magnificent 7 account for 34% of the value of the S&P 500. The remaining 493 stocks account for just 66%.

The stock market is unusually lopsided. Any problems at giants like NVIDIA or Microsoft could send markets plummeting.

At the same time, the S&P 493 have a lot of room to run.

As we’ve seen, many of these stocks are solid, old school companies. And they’re trading at prices well below long term market averages.

Investors have given up on the old school stocks. But for some of us, that could be an opportunity.

Wrap-Up

At some point, the AI fever will break.

“Was it all just a fad? Am I about to lose my shirt?”

Everyone will start selling.

Let them! I’ll be holding steady.

And as I do, those 493 forgotten stocks will function as a stabilizer. John Bogle nailed it:

“Reversion to the mean is the iron rule of financial markets.”

Note: This is NOT investment advice. I have 0 qualifications to advise anyone on their finances and I don’t seek to do so. I’m only offering opinion and a narrative about what I’m doing with my own portfolio. Please do your own research and make your own decisions.

More on markets:

Using Grok 3 to Manage My Stock Portfolio

Markets Are Overreacting to Tariffs

Hetty Green: The Witch of Wall Street

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.

Leave a comment