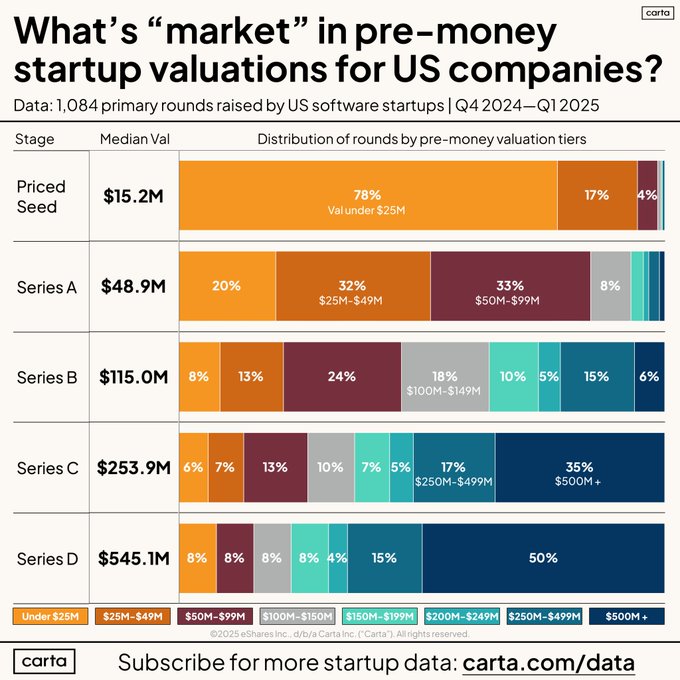

Seed valuations have hit an all-time high: $15.2 million pre-money. Investors are going to have a hard time making money at these prices.

Looking at this new info from Carta, I decided to see what prices I’ve been paying lately.

Behind the Scenes in My Portfolio

Here are the stats on my last 6 deals…

Median Pre-Money Valuation: $9,000,000

Median Raise Amount: $2,000,000

Median Post-Money Valuation: $11,000,000

Median ARR: $239,000

At $9 million, my median pre-money valuation is way below Carta’s. And while Carta doesn’t publish any data on the revenue of the companies that were funded, my guess is that most of them had under $200,000 in revenue.

Carta also doesn’t tell us how much the companies in their sample raised. But my guess is around $3 million.

That would put them at an $18 million post, compared to $11 million for me.

Is Something Missing from Carta’s Data?

There is one little caveat that may be skewing Carta’s data.

Most seed rounds are done as SAFE’s. But Carta is only looking at priced seed rounds.

These priced rounds may be in companies that are a little more mature. At that point, a higher price could be justified.

I’d like to see Carta include data from seed stage SAFE’s as well. That would give a more representative view of the market.

Big Firms Move to Seed

One thing that’s driving these higher prices is big funds doing more seed deals. If the team looks at all promising, they’ll throw in $5 million at a $25 million cap or even a $50 million cap.

They don’t care about making money on that check. All they want is an option on the startup’s later stage rounds.

This means that a guy like me, who specializes in seed and pre-seed, needs to be careful. I actually have to make a return from these bets, unlike the giant multistage funds.

Wrap-Up

Right now, people are willing to pay any price for a hot AI deal.

So, we’re seeing “seed” deals at $50 million, $100 million, even $500 million. Even the median has topped $15 million.

All this for companies with little to no traction. Investors are convinced the upside is unlimited.

But trees don’t grow to the moon.

AI is a great investment, but not at any price. I’m sticking to companies with real traction raising at prices that make sense.

More on tech:

The Coolest Startups at ERA Demo Day

When an Investor Pulls Your Term Sheet

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.

Leave a comment