Note: This is not investment advice.

“They watched their fathers get up at the crack of dawn, work all day, and then spend all night going through invoices, setting schedules, and other mundane business tasks.” From these humble beginnings sprang a $9 billion company.

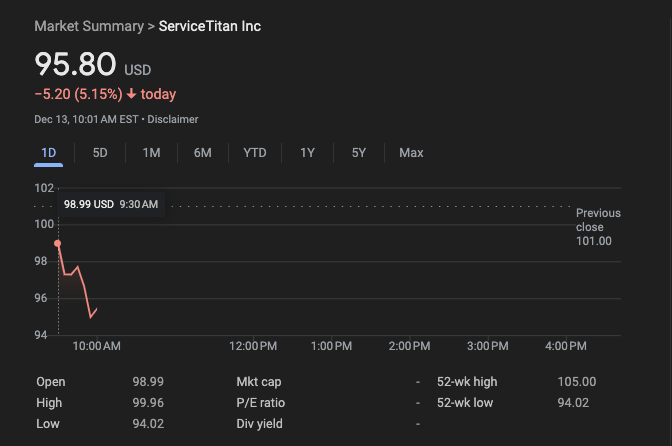

Yesterday, ServiceTitan went public on NASDAQ. Markets have welcomed the LA-based SaaS company, giving it a healthy $9 billion valuation and a 12x ARR multiple.

Bessemer Partner Byron Deeter led the Series A and wrote a great piece on how ServiceTitan came to be, which I quoted above.

The intense founder-market fit really stands out. To work nonstop on a problem for over 10 years, you need to care deeply about it.

Founders Ara Mahdessian and Vahe Kuzoyan are laser focused on their customers.

During COVID, they even gave webinars to tradespeople to help them with safety protocols. This helped the tradespeople keep their businesses open.

So, how does ServiceTitan stack up as a business?

The company has $772 million of implied ARR, based on their latest quarterly results. They’re growing 24% YoY and haven’t reached profitability yet — their net loss over the last 12 months stands at $183 million.

Net dollar retention is strong at 110%. But the burn multiple concerns me.

It’s sitting at 2.6 for the latest quarter, a little high for a company at this stage. Reducing those losses will be a priority.

If the stock holds up over the next few months, more startups will have the courage to IPO. And that’s on top of strong performance by other recent IPO’s like Reddit and Instacart.

Some day, I hope to have my own ServiceTitan, ringing the bell in Times Square.

Congrats guys!

What do you think of the ServiceTitan IPO?

Have a great weekend, everybody!

Note: This is not investment advice.

More on tech:

Why Most Startups Suck at Enterprise Sales

Lessons From My 3 Most Challenged Investments

Learning From My Top 3 Investments

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.

Leave a comment