Note: This is not investment advice.

Every day, my Vanguard account seems to hit a new all-time high. I’m loving it, but it also makes me worry — are we headed for a crash?

A Tour of Indicators

This morning, I looked at four valuation indicators for the US stock market as a whole. Every one of them says stocks are overvalued.

Let’s start with the Buffett Indicator.

This indicator measures the aggregate market cap of all stocks in the Wilshire 5000 divided by US GDP.

The Wilshire includes almost every publicly traded stock in America. Dividing their total value by GDP shows us how stocks are valued relative to the economy as a whole.

The Buffett Indicator is flashing red. It indicates stocks are extremely overvalued right now, by far the worst since at least the 1970’s.

Scary. But we shouldn’t go based on one indicator alone.

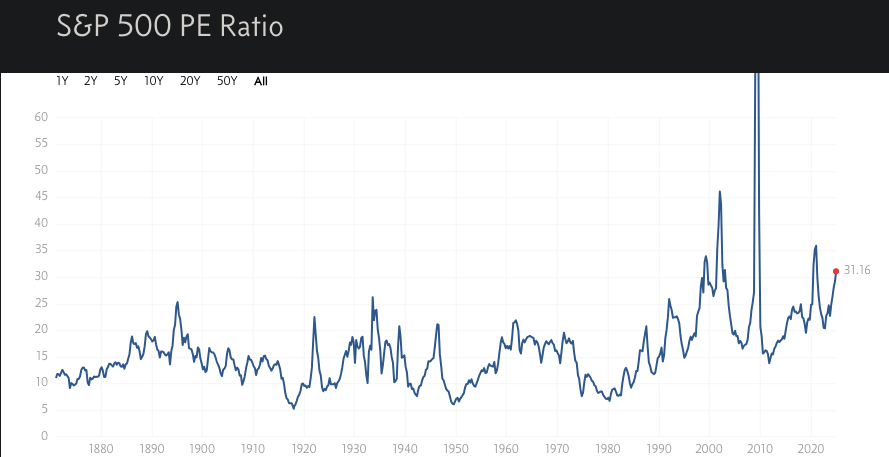

Let’s look at the S&P 500 PE ratio next.

This measures the total value of all stocks in the S&P divided by their total earnings. It’s a great way to see if major US companies are overvalued or undervalued.

This one is looking pretty bad as well. The current PE is roughly twice the historical average, although lower than during the dotcom bubble or the housing boom of the 2000’s.

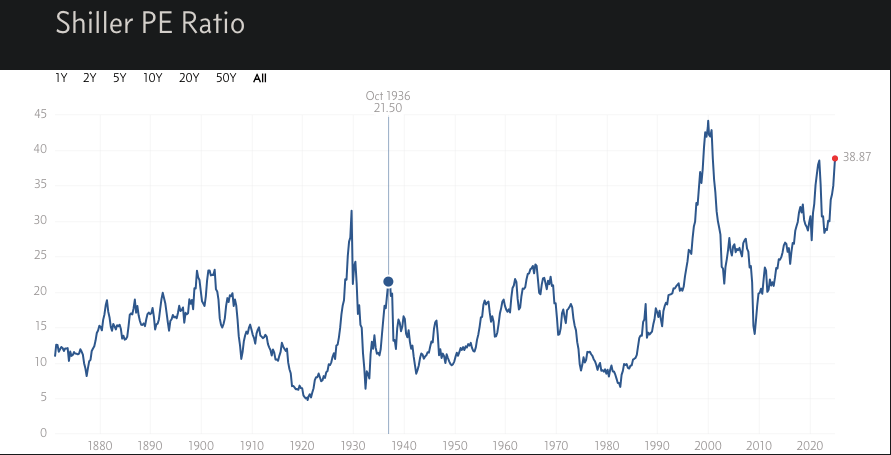

Next, let’s check out the Shiller PE ratio.

This figure measures the current value of the S&P 500 divided by the average inflation-adjusted earnings for the last 10 years. The Shiller PE smooths out short-term deviations in earnings, which helps us see long term trends.

The Shiller PE is also flashing red.

It’s not saying that current prices are unprecedented, the way the Buffett Indicator is. But the Shiller PE still indicates that stocks are almost as overpriced as during the dot-com bubble.

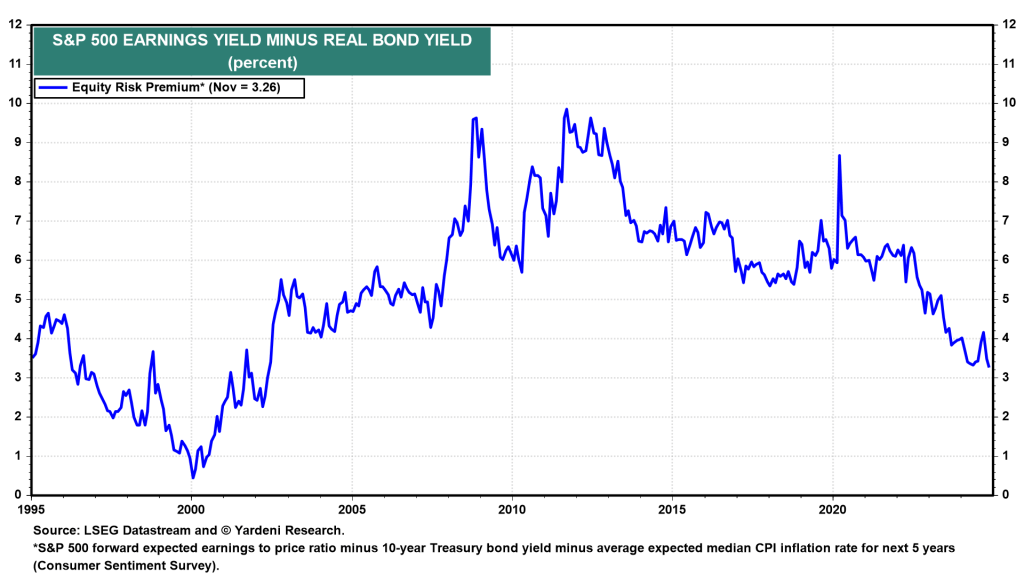

Finally, let’s look at the Equity Risk Premium (ERP).

This number shows the earnings yield of the S&P 500 minus the real (or inflation-adjusted) yield on bonds.

The earnings yield is the inverse of the PE ratio. It tells us what percent of the money we put in stocks we get back in earnings every year.

If we’re going to own stocks, we need to be getting paid enough extra money to accept the risk. Keep in mind, we could always put our cash in risk-free government bonds instead.

The ERP also indicates a steeply overvalued stock market.

All four of our indicators are saying the same thing: US stocks are significantly overvalued right now. The indicators differ on how extreme that overvaluation is, but they all agree prices are way too high.

American Exceptionalism

These days, America is the prettiest girl at the dance.

We’re growing faster than any other developed market. Our companies are crushing it, churning out earnings in the tens of billions.

All over the world, people are wondering how we do it. And they’re piling into US stocks.

No wonder they’re pricey!

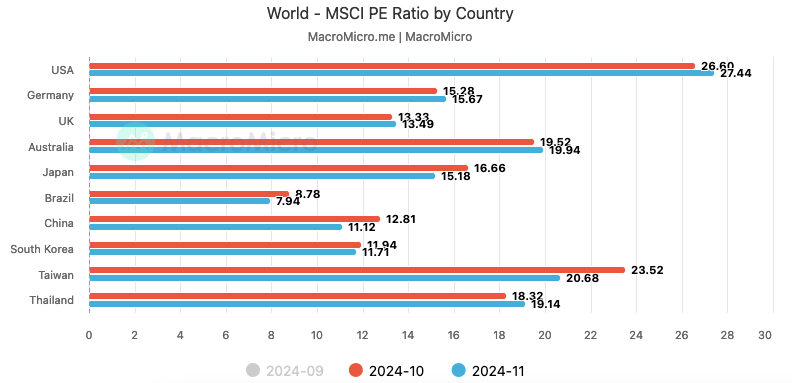

But if we look at markets around the world, we get a very different picture. The PE ratio of stocks in many major countries, like the UK and Germany, are far below the American level.

Granted, many of those countries aren’t growing much, if at all. But that’s bound to change eventually.

Today, America is up. But there will come a time when we’re down.

This is why when I need to sell off a little stock to fund an angel investment, I sell my US stocks. I’m holding on to my shares in overseas index funds — they’re priced right.

Wrap-Up

We never know whether stocks will go up or down. But we have enough data to say that US stocks look significantly overpriced.

So, am I dumping all my US stocks? Hardly.

Over the next 10, 20, or 30 years, American companies are going to keep innovating and growing. In the very long run, US stocks are likely to continue to rise.

So I’m going to sit tight. Sometimes, the most profitable thing you can do is nothing at all.

We’ll get back to startups tomorrow. I have an exciting new investment to announce!

What are your thoughts on the market today?

Note: This is not investment advice.

More on markets:

Lessons From My 3 Most Challenged Investments

Learning From My Top 3 Investments

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.

Leave a comment