Note: This is not investment advice.

Most startups are terrified to go public. But a brave handful have entered the public markets recently. So, how have they done? Is the IPO window finally opening up?

Let’s go through 4 tech companies that went public in 2023 or 2024 and see how they’re faring…

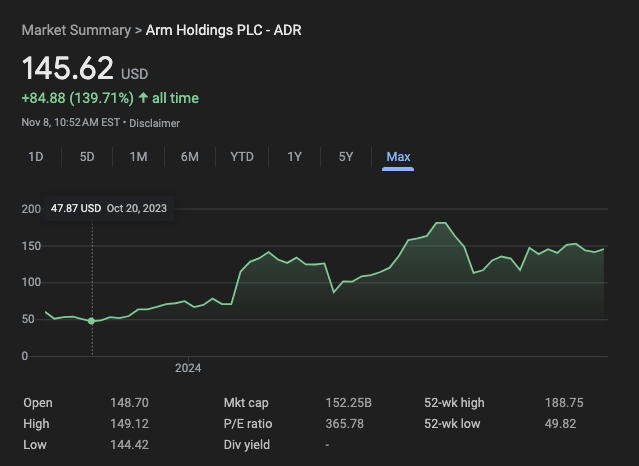

ARM – This semiconductor company went public last September. Its stock has more than doubled since, driven by enthusiasm for the chip sector. AI is using huge numbers of chips, which can benefit companies like ARM.

ARM is solidly profitable, running at about a 15% margin. It’s also growing almost 20% a year.

A hot sector, substantial profits, and solid growth — no wonder the markets like it! Of these 4, it looks like the most solid company.

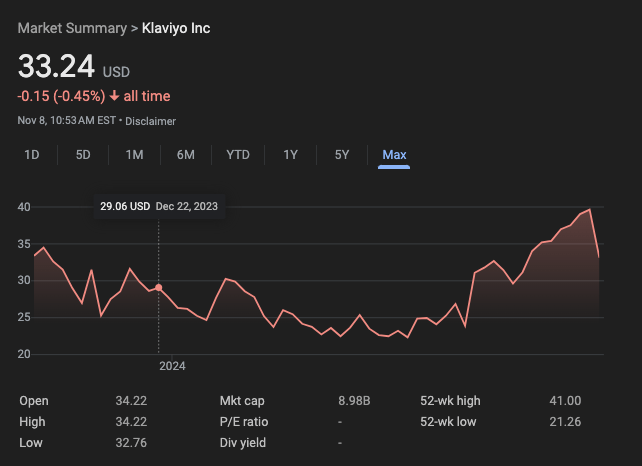

Klaviyo – For those of us who do a lot of SaaS, Klaviyo is the most important company to watch.

This email marketing platform went public around the same time as ARM. The market’s reception has been muted — the stock has been flat since the IPO.

Klaviyo is growing about 25% YoY and making a small loss. If it could get to profitability, the stock could rip.

Still, it’s hardly a wipeout.

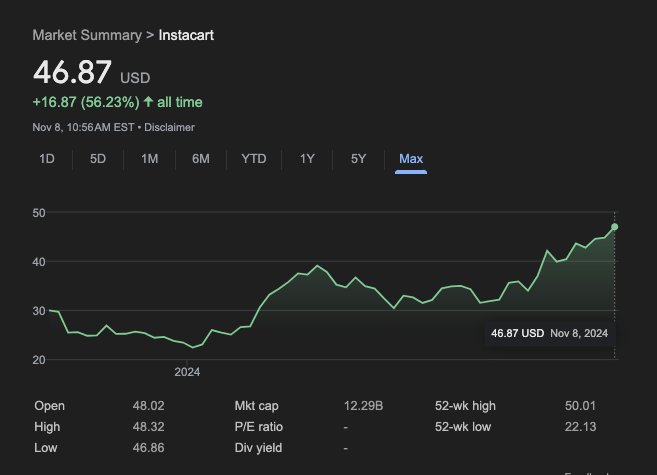

Instacart — This household name went public around the same time as ARM and Klaviyo and has prospered in the public markets. It’s up more than 50% since going public.

A VC I know was one of the first investors — I bet he’s drinking some pretty fine wine these days!

Markets have embraced Instacart despite huge losses and only modest growth. The company has lost nearly $1.7 billion in the last year.

To me, the stock seems overpriced. But time will tell.

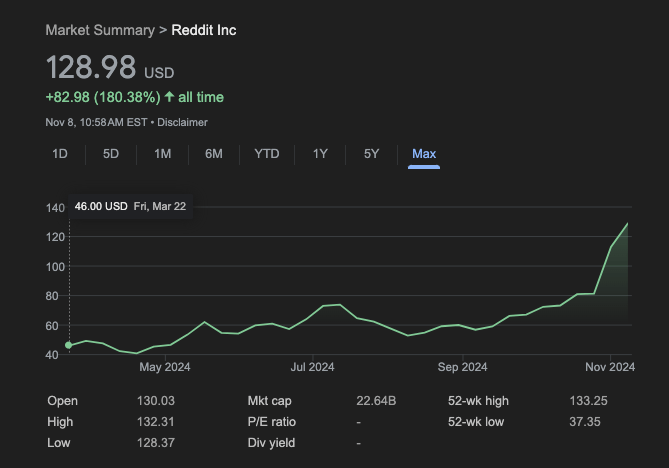

Reddit — The biggest surprise on this list is Reddit. The social media site went public in March and has nearly tripled since!

Investors are excited about the potential for licensing deals with AI companies. That could bring in big money. Already, Reddit has signed deals with Google and OpenAI.

The company may have big potential, but its finances today are strained. It lost over $500 million in the last year. Growth is solid but not enough to justify those kind of losses.

Like Instacart and much of the stock market right now, Reddit seems priced to perfection.

Wrap-Up

Overall, the market has been incredibly receptive to these companies.

3/4 are up and one is flat. Nobody has been wiped out in the public markets.

For all the talk of public markets wanting profitability, big losses haven’t stopped these companies. Instacart and Reddit are losing gobs of money and their stocks are doing great.

In all, the IPO window is looking pretty open to me. Let’s get our startups public and secure those bags!💰

Which of these stocks is your favorite?

There will be no blog on Monday for Veteran’s Day. See you Tuesday!

More on tech:

Small Investors Lead to Big Investors

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.

Leave a comment