This morning, I spoke with my mom on the phone. Like many people, she was worried about the falling market. So I’ll tell you guys what I told her: I’m not selling anything.

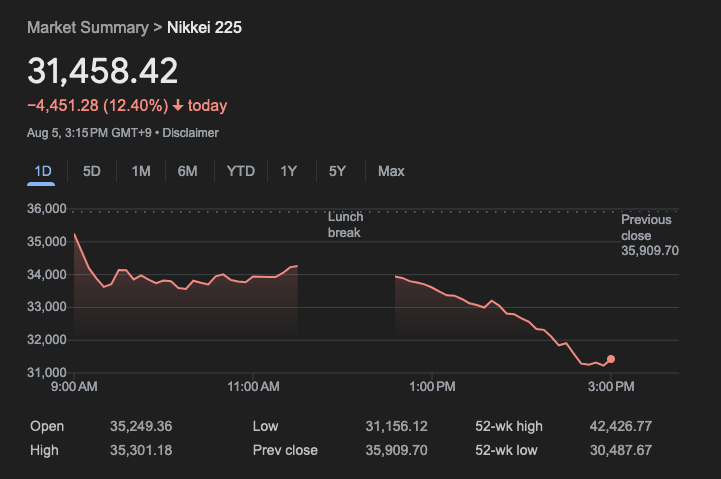

The turmoil started overnight, with Japan’s Nikkei 225 falling 12%, its biggest fall ever. Korea’s Kospi fell 9%, and crypto took a steep dive as well.

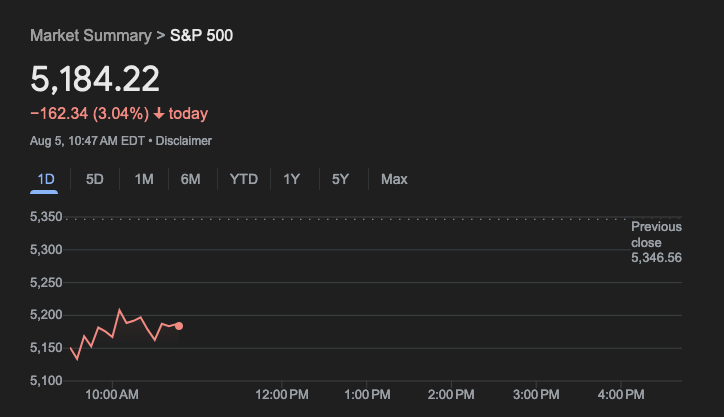

The shockwave hit America next. The S&P 500 is down 3% as I write this on Monday morning. The Nasdaq is down a bit less, at 2.8%.

Stocks reacted to fears the US may be near recession.

American Business Keeps Winning

I’m not investing for tomorrow, and neither are you. We’re investing for the next 30 years.

So let’s zoom that chart out a bit and see what’s happened to US stocks in the last century:

Our data begins in January 1928, with the S&P at 319. It rocketed above 500 in the Roaring 20’s, only to sink to a low of 100 during the Great Depression.

It took nearly 30 years for the S&P to get back to its late 20’s high. It then continued rocketing upward through the 1960’s.

The 70’s were lackluster, followed by incredible gains in the 80’s and 90’s. Then came the dot com crash.

Getting back to that early 2000 high took 14 years. And since then, stocks have doubled again.

What’s the pattern here? Stocks go up, then fall and stay cheap for long periods.

But inevitably, they recover. The S&P is worth 16 times as much as it was in 1928. Looking back 30 years to when I was a boy, stocks are up more than fivefold.

At any point in this series, the wise move was to buy and hold.

The AI Revolution Continues

Just a couple of weeks ago, stocks hit an all-time high. Investor excitement about AI reached a fever pitch.

Has anything changed in AI? No.

Companies are still creating incredible new tools using LLM’s. And I’ll tell you what’s even more exciting: people outside tech are starting to benefit.

A friend of mine is a commercial real estate broker in NYC. Friday night, he asked me if I’d ever heard of Claude.

“Yeah, I was actually using it this afternoon,” I told him.

“I just fed the entire New York City zoning code into it,” he explained. “It’s like a 100 page PDF. Then I just started asking it questions, and it could tell me anything I wanted to know about zoning in New York.”

What might have taken him half a day without AI was down to 5 minutes.

We’re just getting started with AI. The productivity gains we’re going to see will be unlike anything we’ve seen before.

Retail Gets Savvy

As markets wobble, you might expect average investors to run for the exits. But the retail crowd has come a long way from the meme stock craze of 2021.

Retail traders were net buyers this morning. They snapped up shares of Magnificent 7 stocks like Nvidia just as others were dumping them.

I prefer the diversification of an index. But these retail fellas had the right idea — now is a buying opportunity, not a time to sell.

Wrap-Up

Whatever happens today, there’s only one question that matters. In 30 years time, do you think American business will be worth more, the same, or less?

American businesses and their peers abroad keep innovating. This is true in good markets and bad.

When you own stocks, you own a share of that innovation. Long term, it’s hard to lose.

What are your thoughts on the market turmoil?

More on markets:

Top-Heavy Markets Spell Trouble for Late Stage Startups

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.

Leave a reply to Street Fighters: The Last 72 Hours of Bear Stearns, the Toughest Firm on Wall Street – Tremendous Cancel reply