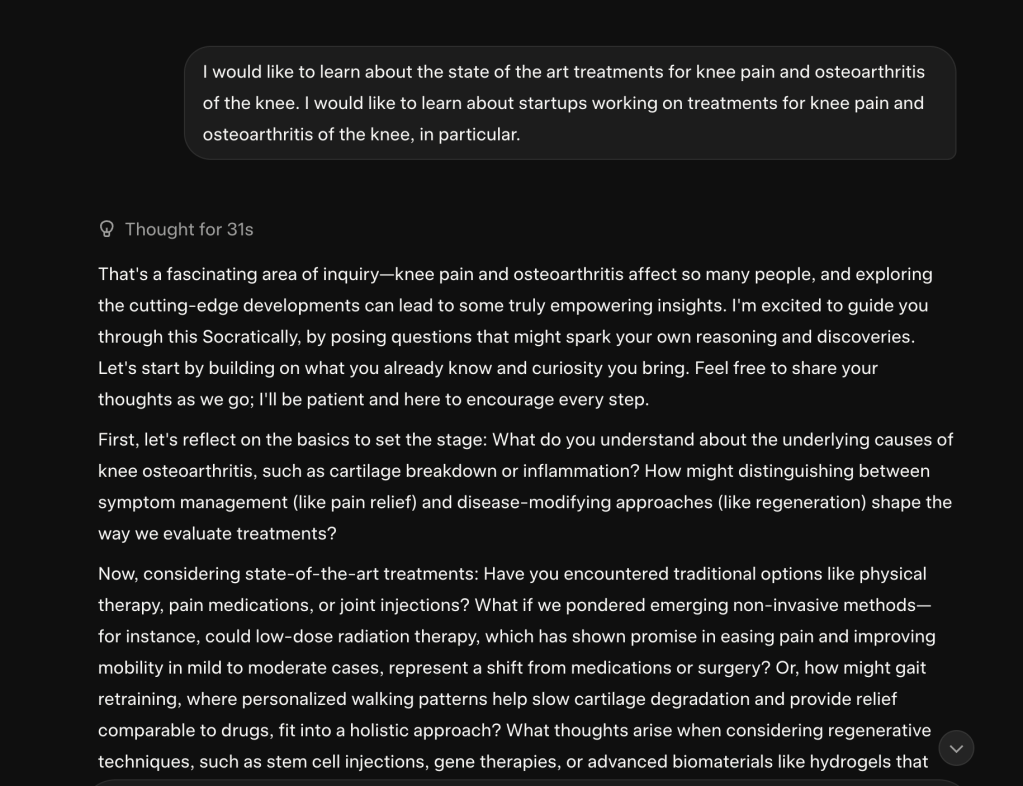

“Ugh, I still have to send that investor update.” Ever had this thought after a 90 hour week? Here’s why updating your investors helps you win…

How to Write an Update

First, you need to know how to write a good update.

Don’t write a novel. Just cover these points:

- Asks for investors

- Revenue

- Burn

- Cash in Bank

- Runway

- Highlights

- Lowlights

- Next month’s plan

Writing this update should take you 30-60 minutes. One hour, once a month.

Monthly Updates = Timely Help

You should send updates monthly. That gets you help in a timely fashion.

Say you need a new engineer. Put the “Asks” at the top and ask investors for intros.

If one of your investors introduces you to a strong prospect, your job just got a lot easier!

If you only update investors every quarter or two, you don’t get help when you need it. You need that engineer today, not 3-6 months from now!

Making Fundraising Easier

Let’s say you go silent for a year. Now, the company is struggling and you need those investors to write another check.

Good luck getting it! Many have already written you off.

Had you updated them every month, they might have enough confidence to re-invest.

Getting an Overview of Your Business

You’re immersed in details every day. You’re fixing a bug, answering an urgent question from a customer, and flying to a conference.

It’s easy to lose the big picture. How is your business doing overall?

Investor updates give you an overview. Even if you have no investors, write an update for yourself!

What Companies Get an Exception?

I have a couple startups that I rarely hear from. And that’s okay.

These companies have scaled to tens of millions in revenue. I have a ton of confidence in these founders. I’d rather they spend time growing the business than write a monthly update.

But it’s still nice to hear from them once in a while! And I get an update at least once a year, even without asking for it.

But if you’re early stage, stick to monthly updates.

Wrap-Up

Sending monthly updates gets you the intros and advice you need, when you need them. It also helps you raise money in the future.

But there’s another reason to send investor updates.

People trusted you with their money. You owe it to them to keep them updated.

Now, sit down and write that update!

More on tech:

How to Tell If Investors Are Really Interested

How to Build a Relationship with Investors

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.