“Can you demo the product for me?” the investor asks. This is where you close the round…or watch the deal die.

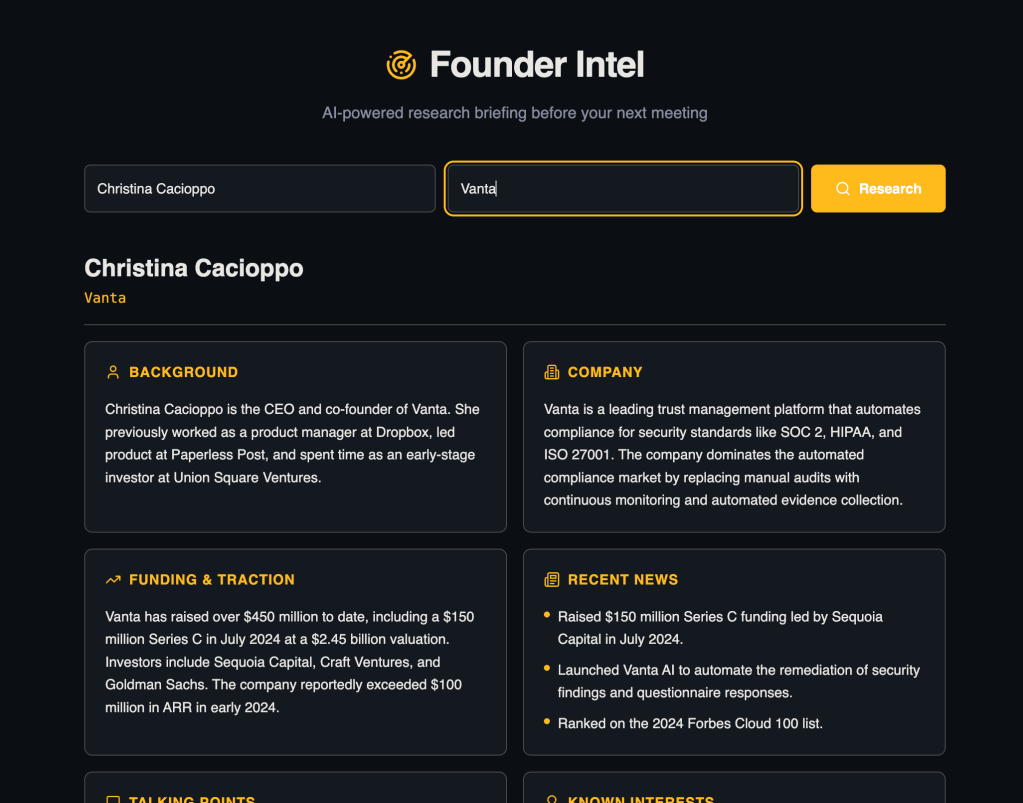

Founders agonize over every word in their deck. But a great demo is worth more than any PowerPoint.

Here’s how to deliver a demo that raises millions…

Focus on Workflows, Not Screens

Don’t just show screen after screen. Focus on the core workflow and the benefit to the customer.

Doing a feature death march is the biggest mistake founders make.

No one cares how many screens you have. We care what you can do with them!

Say you’re making an AI CRM. Show us how the customer updates the CRM after a sales call and why it’s easier than your competitor.

Don’t Show Real Customer Data

Don’t show real customer data to an investor. Instead, use a test environment.

Be sure it has enough data to resemble a real customer environment. You want your demo to be realistic as possible.

Keep It Under Five Minutes

Don’t put investors to sleep with a long demo. Keep it to five minutes tops.

This should be enough time to show your core workflow.

Some founders give extremely long demos, 10-20 minutes. It’s just too hard to keep somebody’s attention for that long.

Practice Makes Perfect

When you do a demo, you don’t want any hitches. Practice over and over until it’s perfect.

Have one of your co-founders play the investor. Tell them to point out problems and ask questions.

They know more about the product than any VC. If you can deliver a demo that satisfies them, you should crush it in your investor meetings.

The Demo That Keeps on Giving

Be prepared to deliver the demo live. You should also record a video of the demo to share.

There’s a lot of great tools to record demos, such as Loom. Share the demo link along with your deck when you message an investor.

This shows your product isn’t vaporware. It also gives them a chance to get excited about what you’re building.

That raises your chance of getting a meeting!

Wrap-Up

The same deck can describe a hundred startups. The demo gives you a chance to stand out.

Practice until you have every step down pat. Keep it short and focus on the value to the customer.

Show investors why customers love your product. If you can do that, you’ll have them reaching for their wallets.

More on tech:

Your Deck Probably Sucks. Here’s How to Fix It.

Which Accelerators Are Worth Your Time? Here’s How to Find Out.

Three Easy Ways for Frazzled Founders to Save Time

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.