US growth is trouncing Europe and most of the developed world. While other countries are still struggling to recover economically from COVID, America is racing ahead.

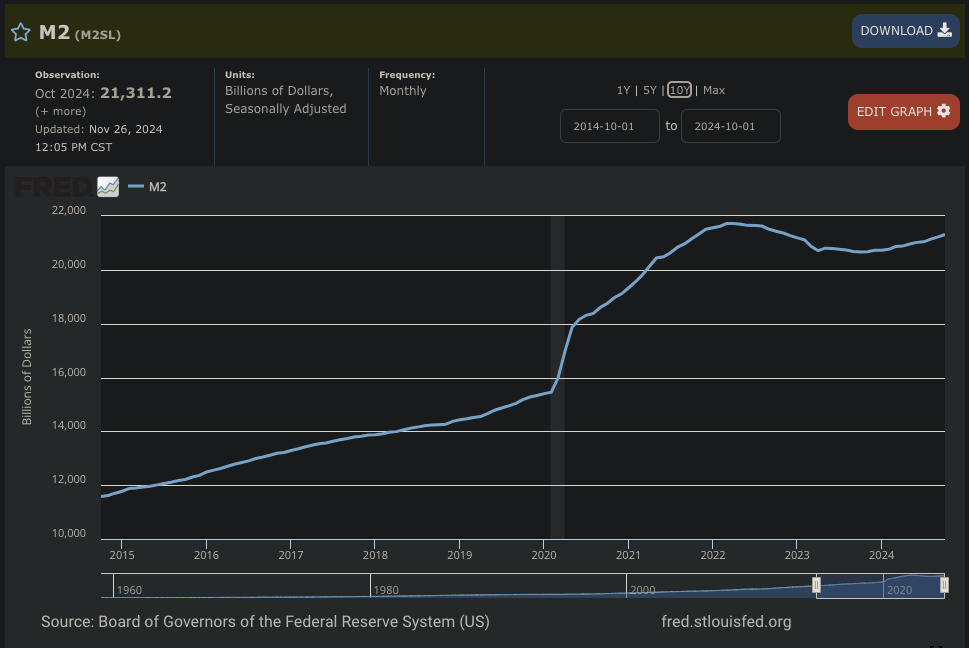

Bold federal spending during COVID is a key reason why the US is outpacing the rest of the world. Mark this day — I finally said something nice about the government!

US GDP has been on a tear in recent years, growing 27% from 2019-23. Meanwhile, the Eurozone GDP grew just 15% (data from the World Bank).

The US has rebounded strongly. But it’s taken major government investment to do it.

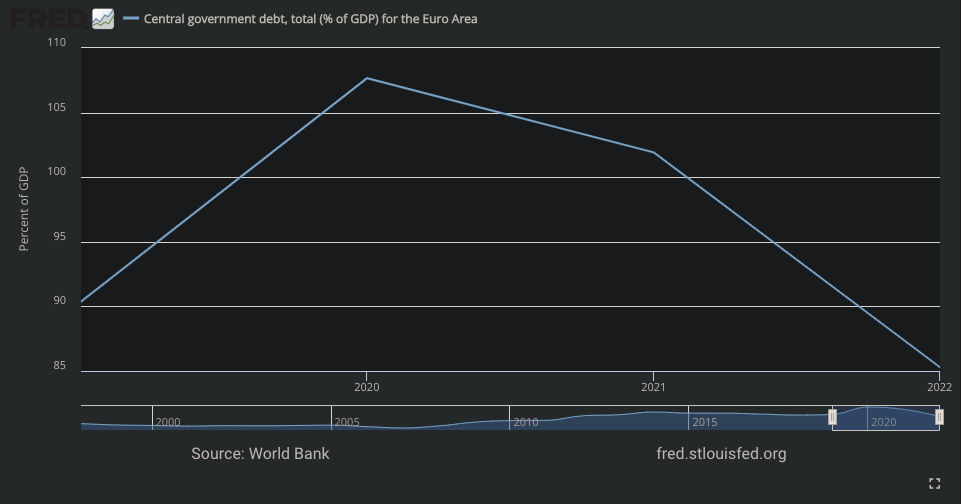

US national debt as a percent of GDP went from 104% to 120% from 2019-23. Meanwhile, the Eurozone’s debt actually fell as a percentage of GDP.*

America’s debt is high, no question. But Europe’s policy during the crisis makes no sense to me.

COVID sweeps the world, the economy collapses, and their debt goes down? What are they thinking?

If ever there were a time to stimulate the economy, it’s when lockdowns are putting huge numbers of people out of work.

It’s no wonder that years after COVID, the Eurozone still hasn’t recovered to its historical trendline. Meanwhile, the US recovered by 2022.

Government spending is not the only factor in higher US growth.

American tech companies are crushing it, minting multibillion dollar profits. Meanwhile, Europe produces few new, major businesses of any sort.

The combination of bold spending in a crisis and a culture of innovation are keeping America on top. But now that we’ve recovered from COVID, it’s time to get that debt under control.

What do you think of American and European economic performance?

*Unfortunately, the Federal Reserve only has Eurozone debt data going through 2022. I wasn’t able to find another reliable source for this figure, so I’ll go with these numbers, even if they’re not as current as I’d like. If you see a better data source, let me know! 🙂

More on markets:

Lessons From My 3 Most Challenged Investments

Learning From My Top 3 Investments

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.