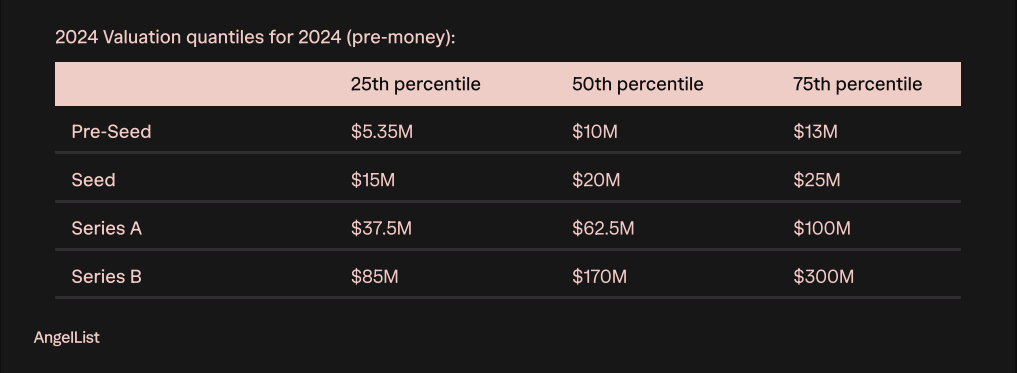

Valuations for early stage startups jumped in 2024, according to a new report from AngelList. Pre-seed valuations are up 20% while seed prices rose 18%.

Median pre-seed valuations hit $10 million pre-money. Seed reached a heady $20 million.

This marks a big increase from 2023, when the median pre-seed was $8.3 million and seed was $17 million.

Why Are Valuations Up?

This jump in valuations is driven by two things: AI fervor and big funds moving earlier.

Just yesterday, I used Gemini Deep Research for the first time. It’s the most incredible thing I’ve seen since I first used the internet 30 years ago.

No investor wants to be left behind when breakthroughs like this are happening. So, many VC’s are piling into AI startups without regard to price.

What’s more, big multistage funds are moving earlier. If you’ve got a $1 billion fund, a $4 million seed check is nothing to you. The dealflow alone could be worth the investment.

These funds have money to burn and are not price sensitive. That pushes up valuations across the market.

What’s Going On In My Portfolio

The prices I’m investing at are much lower than what’s on AngelList.

My median pre-money valuation in 2024 for a pre-seed was $5.75 million, versus $10 million in the AngelList data. My median pre-money valuation for a seed round was $12.5M, versus $20 million on AngelList.

My gut tells me that the AngelList valuations are a lot higher than the market in general.

I see a ton of AngelList deals. They tend to be buzzy rounds at high prices. There is often a big name, multistage fund leading the deal.

It makes sense that syndicates on AngelList do deals like this. It’s easier to round up investors if there’s a big name leading the round.

But those hot rounds don’t necessarily provide the best returns.

Wrap-Up

I expect 2025 to be a strong year for early stage startup funding. The upward trend from 2024 is clear, and with AI excitement high as ever, there’s no reason for that to change.

As for me, I’ll be doing what I’ve always done: investing in the best startups I can find at reasonable prices.

I’m very excited about AI too. But we cannot completely disregard traction and entry price, no matter how promising the future seems.

More on tech:

DeepSeek vs. Gemini Deep Research: Which Model Is King?

Meet My Latest Investment: Querio

I’m About to Close the World’s Tiniest Venture Fund

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order. ![]()