“Help me pick up red onions.”

“Taking you to red onions.” This is how Sharon Giovinazzo, a blind woman in San Francisco, buys groceries these days. Her helper isn’t a person — it’s AI glasses from Meta.

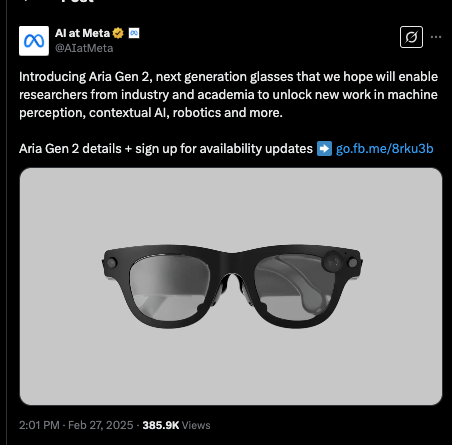

Sharon lost her vision at age 31. Now, she’s one of the first users of the new Aria Gen 2 glasses.

These glasses have cameras, mapping, microphones and speakers. They see her environment and tell her how to navigate it.

Meta announced these new Gen 2 glasses yesterday. They have better cameras and sensors than the Gen 1 and will be available to researchers later in the year.

The Gen 2’s are very practical. The battery lasts 6-8 hours and they weigh just 75 grams. To put that in perspective, the regular prescription glasses I’m wearing now weigh 36 grams.

The Aria Gen 2’s are incredible for the blind. But they also have exciting applications in robotics.

You can wear them while doing a task like washing dishes. The cameras and sensors in the glasses pick up tons of data, which can then be fed to a robot.

With enough of that data, the robot will be able to wash dishes too.

The Aria Gen 1’s collected a mountain of data that robots are using now. This may be one of the reasons that we’ve seen such incredible advances in humanoid robots lately from companies like Figure and Unitree.

These glasses are incredible for the blind and for researchers. But would average people ever want to use something like this?

I’m doubtful. It’s hard to get people to wear prescription glasses they really need. Getting them to wear glasses they don’t need would be even harder.

I’m used to wearing glasses. I’ve been wearing them since I was 4 years old — 35 years!

But most people aren’t used to it. And a device on your face is a lot more intrusive than a device in your pocket.

That said, smart glasses could be invaluable for certain jobs.

I have a small investment in a startup called Argyle that applies augmented reality to construction. Argyle can show an outline of where in a building you should install a water pipe. That way, you don’t put the pipe in the wrong place.

It’s a really cool application, and glasses with more advanced sensors could make it even better.

I can also imagine surgeons and semiconductor fab technicians wearing Aria’s. The glasses could guide them to make the right incision or turn the right knob on the photolithography machine.

At this early stage, it’s very hard to say how we’ll use smart glasses.

Perhaps they’re the next iPhone…ubiquitous and the main way we interact with the internet. Or maybe they’re a niche product that are still very useful for the blind, researchers, and folks in certain jobs.

Either way, these new Aria Gen 2’s are awesome. I can’t wait to try them myself!

Have a great weekend, everyone!

More on tech:

Is Biotech Having its ChatGPT Moment?

Using Gemini Voice As My Personal Tutor

Using Grok 3 to Manage My Stock Portfolio

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.