Something weird happened to me recently: I had fun using SaaS. So of course, I invested in the company.

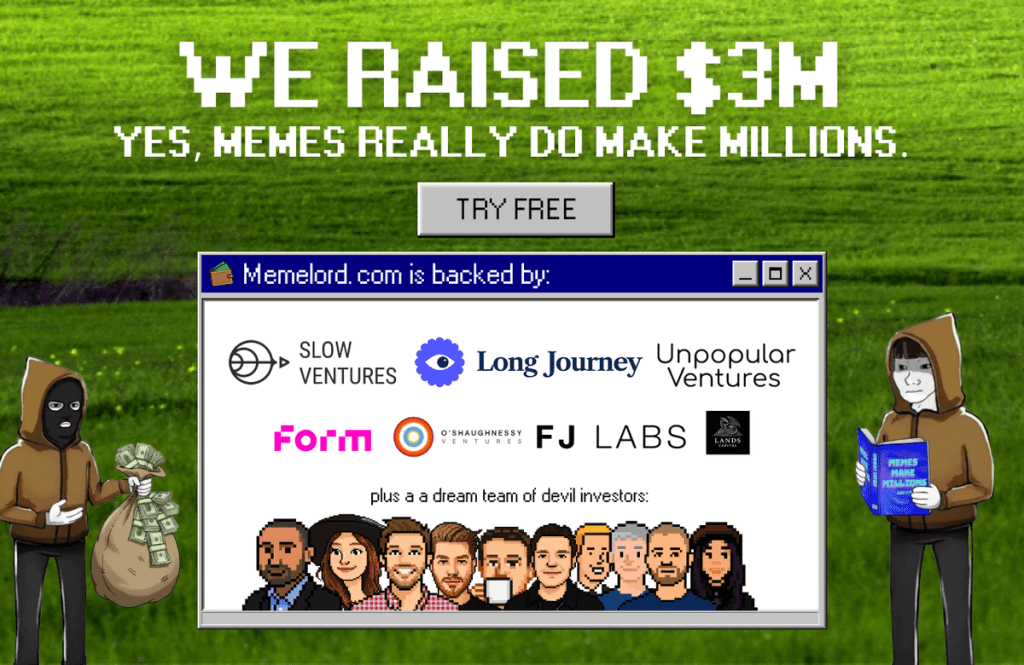

Memelord finds trending memes from all over the internet. Then, it helps you make hilarious versions of them to promote your business.

I always try to use products before I invest. But with Memelord, I found myself coming back over and over, long after I’d tested it sufficiently.

This thing is fun to use!

Founder Jason Levin plans to build the Palantir for Memes.

Palantir sends Forward Deployed Engineers to help customers configure the software and get the most out of it. Jason offers consulting to customers to help them make awesome memes.

Call it Forward Deployed Memelords.

Jason’s approach hit home. I used to work for an Electronic Medical Records company called Epic. Like Palantir, they send staff to customer sites.

I was one of those people. I learned that software plus services can be an incredible combination.

But in the end, the reason I invested in Memelord isn’t really about any of this. It’s about Jason.

The man defines “scrappy.” His energy is boundless, his understanding of marketing instinctive.

He’s just the man for the job. And although I may be the smallest investor he has, I’m delighted to be in business with him.

Check out Memelord and make some awesome memes!

The next blog will be on Monday, October 6. I’m headed to New Orleans next week on vacation! 🥳

More on tech:

Meet My Latest Investment: Verustruct

Why Short Decks Raise Millions

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.