“They’re profitable. Why are they raising money?” Here’s why you should consider raising venture capital even if you’re profitable…

Strike While the Iron Is Hot

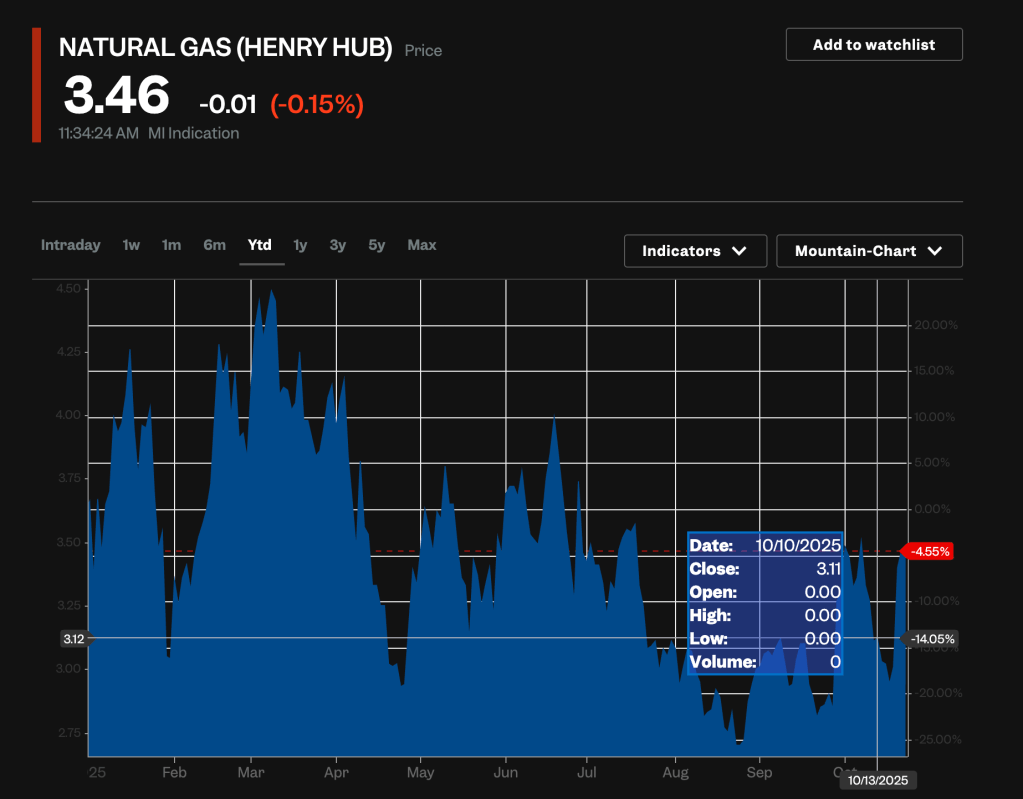

Right now markets are about as hot as they get. It’s the perfect time to raise.

You may not need money now. Maybe you’ll need it in 2027.

But the market may no longer be hot in 2027. The market doesn’t care when you need money.

If it’s easy to raise now, raising makes a lot of sense. You can always sit on the money until you need it.

Profitability Is Fleeting

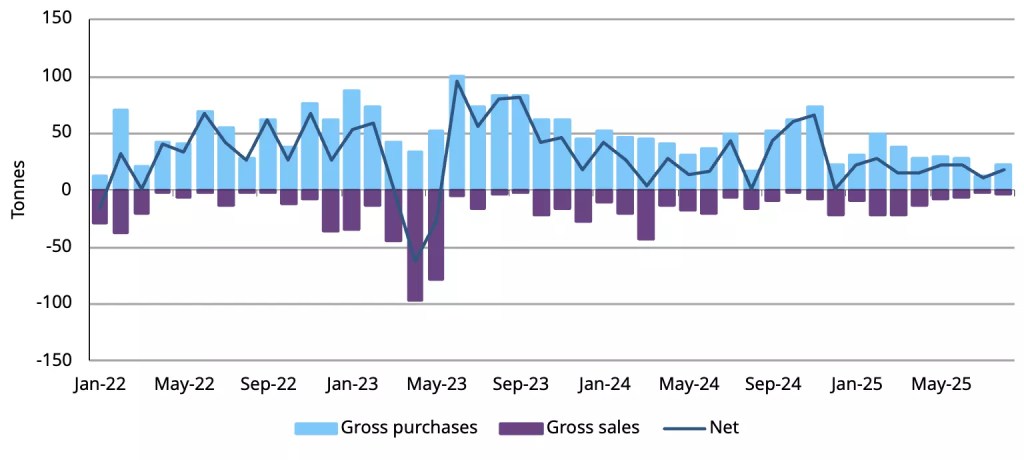

Let’s say you’re profitable right now. If you lose a big customer, that profit could quickly swing to a loss.

I’ve seen this happen in startups I’ve invested in. The company is producing profits reliably for months, then loses a major customer.

Suddenly, large losses appear. Without a cash cushion, the company could die.

Fortunately, when this happened to startups I invested in, they had a capital cushion. They were able to weather those losses, sign more big customers, and get back in the black.

The Vagaries of Usage-Based Pricing

Not all ARR is actually recurring. Especially in a world dependent on AI tokens, an increasing percentage of startups’ revenue is usage-based.

It’s hard to say how much usage-based revenue will come in from a customer in any given month. You may expect to be profitable, but if your customers don’t use your product as much as expected, you could see a large hole in your income statement.

At times like that, it’s awfully nice to have some cash in the bank.

Fuel for the Fire

Raising capital isn’t all about mitigating risk. It can also help you grow faster!

Maybe you know that when you spend a hundred dollars on ads, you make 500 dollars in revenue.

You’ve seen this 5X return over and over. If you raise $2M and burn it on advertising, you are highly confident that you’ll bring in $10M.

In that scenario, you should definitely raise money.

Wrap-Up

Raising money when you’re profitable makes all the sense in the world.

Venture capital insulates you from potential problems. It also helps you grow faster.

So if you weren’t planning on raising anytime soon, I suggest you reconsider. There’s no better time to raise capital than today.

“This is all the time you’ll ever have.” – Hannibal Lecter

More on tech:

Your Deck Probably Sucks. Here’s How to Fix It.

Meet My Latest Investment: Verustruct

Request for Startups: Drones, Healthtech and Art, Oh My!

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.