Elon just dropped Grok 4.1. I tested it this morning. This is the best model I’ve ever used.

xAI’s claims 4.1 has fewer hallucinations than prior models. It ranks number one on LMArena, ahead of Gemini, Claude and ChatGPT.

Let’s see what this thing can do!

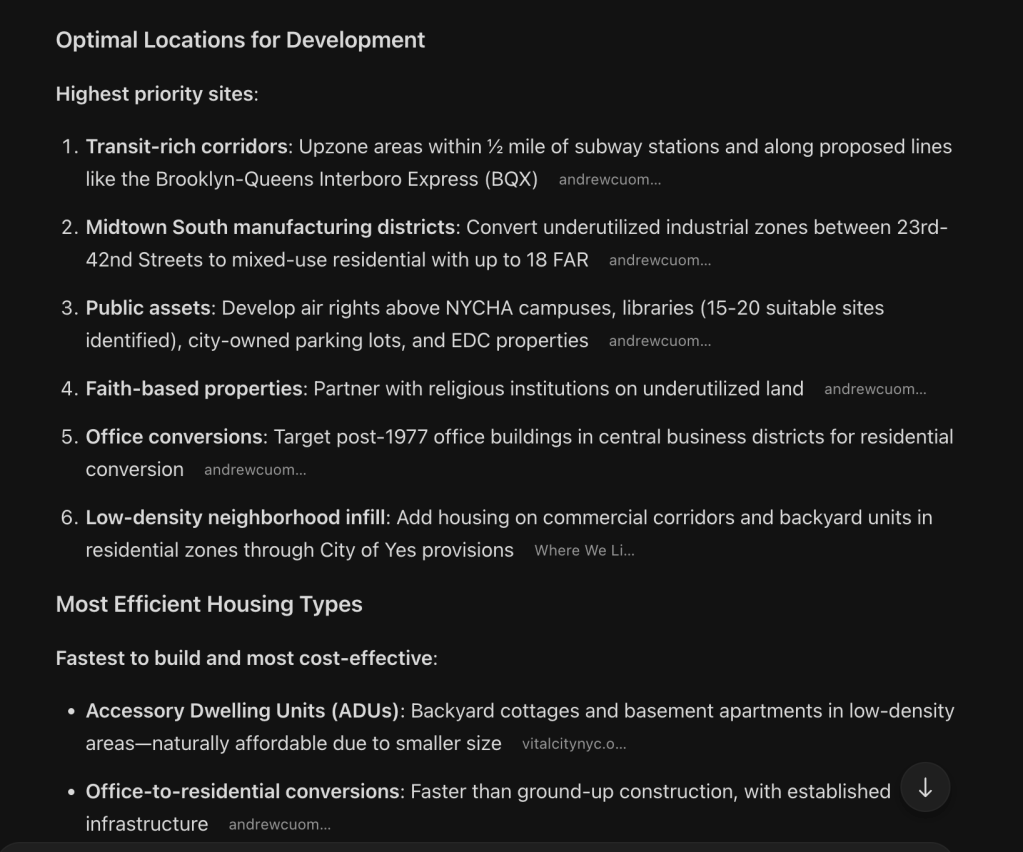

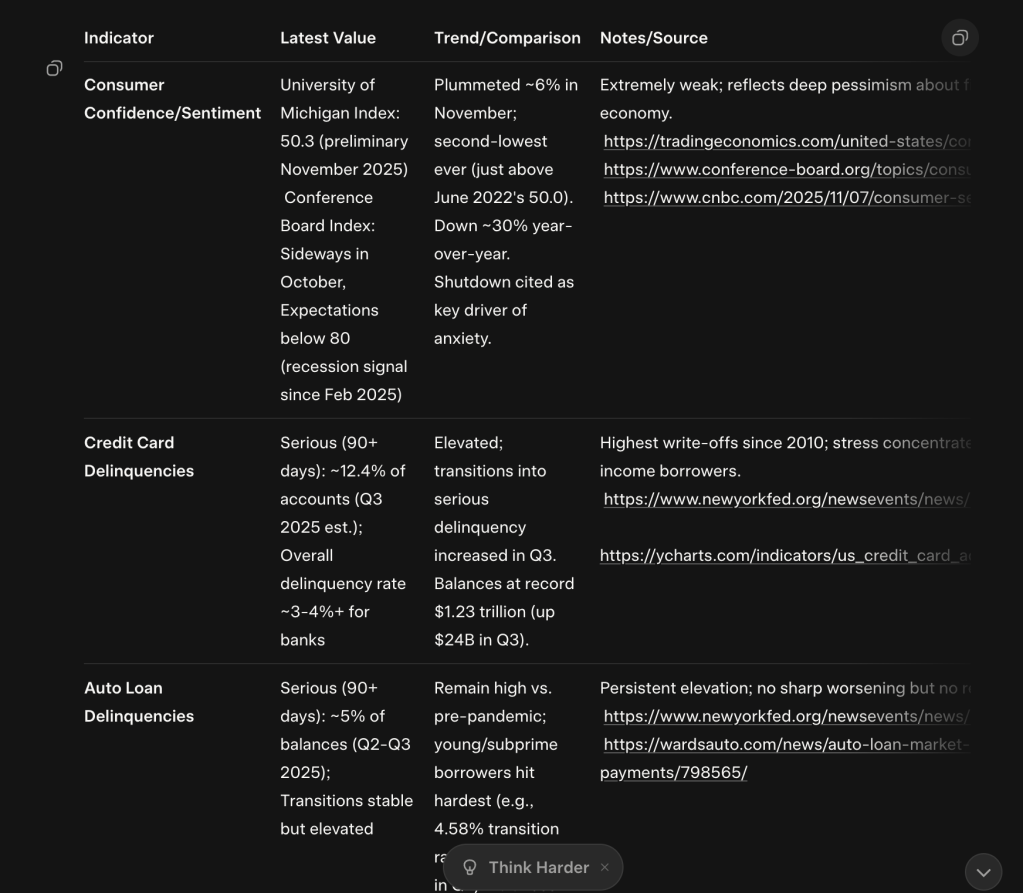

Round #1: Are Consumers In Trouble?

Layoffs in America are surging. Consumer confidence has plummeted. Are we headed into a recession?

I asked Grok 4.1 to help me assess how American consumers are doing.

Grok found that credit card delinquencies are increasing. But auto loan and mortgage defaults are holding steady.

This tells me that consumers are under some financial stress but are holding on for now.

Grok did a great job of finding relevant information and citing sources. That made it easy to verify the stats. It was also faster than Grok 4, scraping sources with incredible speed.

I’m giving this round an A.

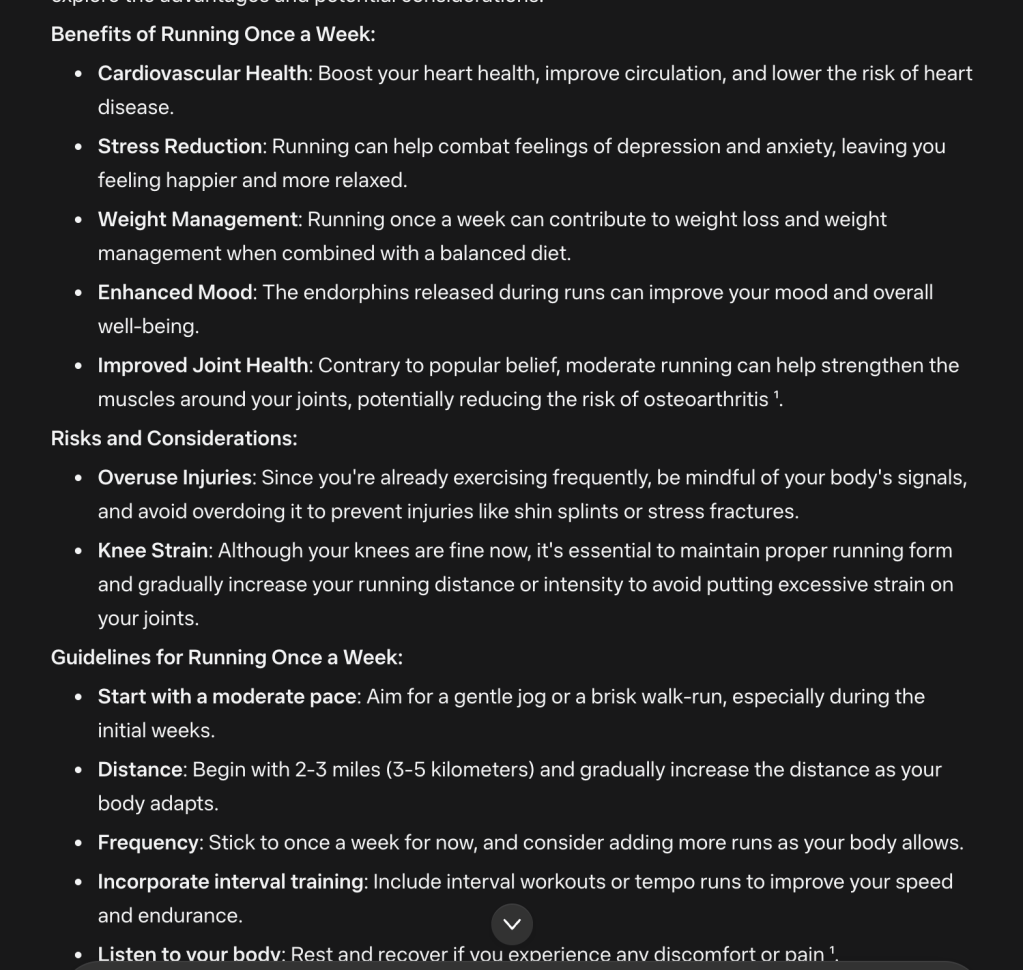

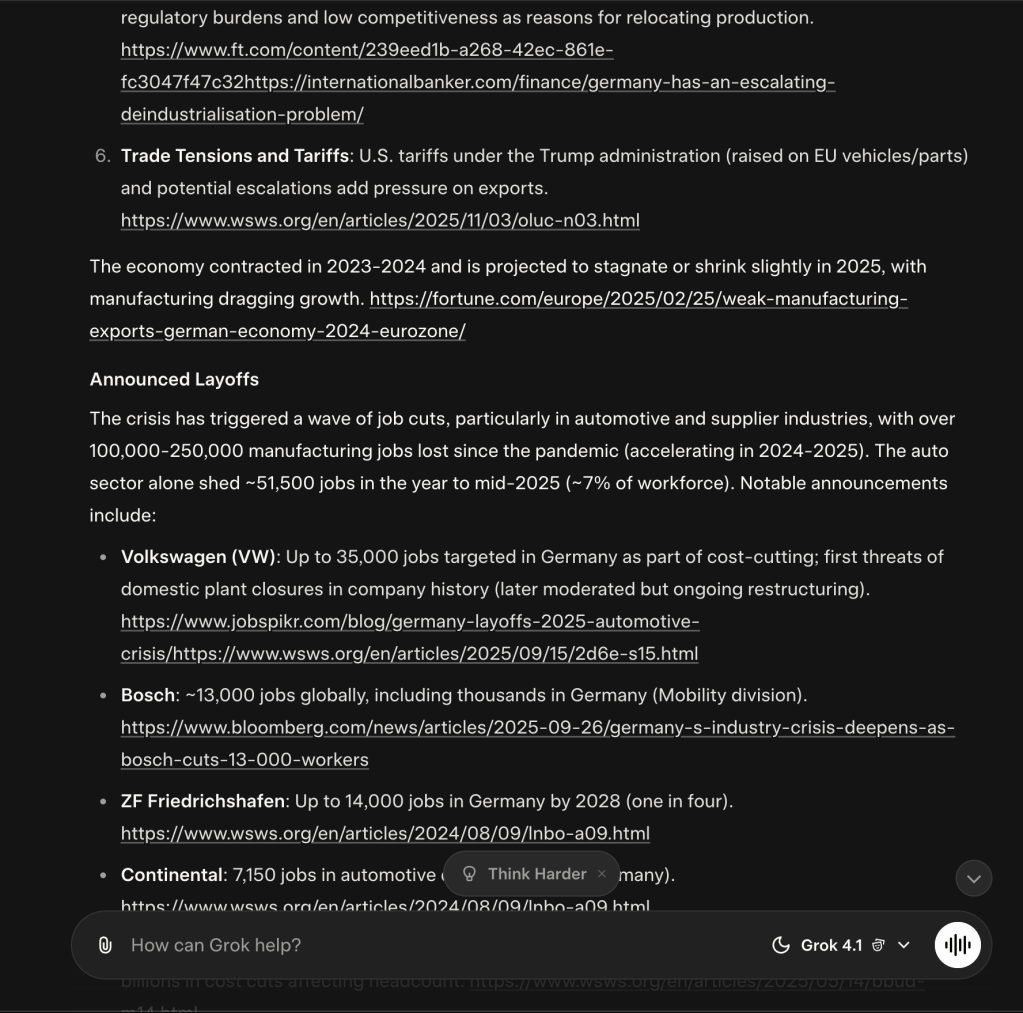

Round #2: German Industry Falling Behind

I keep seeing headlines about problems in German manufacturing. Can Grok 4.1 get me up to speed?

Energy price increases after the invasion of Ukraine made German industry less competitive. German carmakers are also behind technologically.

Facing higher costs and stiff competition, companies like VW and Bosch have done major layoffs this year.

Grok searched 130 results in about two seconds. It searches faster than any other model I’ve tried.

Some of the sources it cites are poor quality, like WSWS.org, a socialist party website. But for the most part, Grok 4.1 delivers a thorough response.

I’m giving this round an A-.

Round #3: Learning About Fighter Jets

This morning on Bloomberg, I heard the United States is planning to sell F-35 fighters to Saudi Arabia. These are the most advanced jets we have.

I wondered, how are these different from other fighters we produce? Let’s ask Grok…

The F-35 is stealthier than other jets. It also shares data with other aircraft and drones, which earlier jets can’t do.

Grok’s answer is thorough, but sourcing could be a bit better. The links sometimes go to homepages for the Air Force and other sites, as opposed to specific pages with information on the fighters.

Overall, I’m giving this round an A.

Wrap-Up

In my testing, Grok 4.1 earns an A overall.

This makes it the best model I’ve ever tested. Grok 4 and Kimi 2 Thinking are right behind, both earning A-’s.

This new model’s speed is astounding. It searches over a hundred sites in seconds.

Grok 4.1 occasionally cites a weak source. But overall, the quality of its responses is very high.

If Grok can nail sourcing in the next version, I’ll give it an A+.

I’m excited to see what applications founders create using Grok 4.1. If you’re building in AI, your capabilities just went through the roof.

Have you tried Grok 4.1?

More on tech:

OpenAI Behind Competitors Despite GPT 5.1 Release

Kimi 2 Thinking — A Real Threat to ChatGPT and Grok

Testing Zuck’s $70 Billion Model

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.