A sleek automobile glides to your front door. You lower yourself in. Let’s ride.

On October 10th, Elon Musk revealed the new Cybercab at the We, Robot event. I’ve been salivating over it ever since.

This morning, I dug a little deeper to find out what our first rides will be like…

Taking Your First Ride

The Cybercab only has two seats. They’re big and spacious. There’s plenty of leg room, partly because there are no pedals.

The ride is smooth and pleasant. Headroom abounds, which we six footers really appreciate. I used to nail my head constantly inside NYC taxis — one of the reasons I take Uber now.

Let’s say we’re stuck in traffic. What’s the difference? The robot is doing the work.

A New Way to Build a Car

Tesla will build the Cybercab in a completely different way from how Ford builds a truck.

The Cybercab’s design is incredibly simple. Its exterior contains just 80 pieces, compared to hundreds on a typical automobile.

In a fascinating interview on the FutureAzA podcast, Robert Scoble breaks it down:

“They can make these on shorter lines, with fewer people, less complexity, less problems, less supply chain complexity.”

Tesla’s likely goal is to have robots do all Cybercab assembly. Robots making robots — that’s when the pace of technological change goes exponential.

Uber, Tesla and Waymo Win

Tons of people are predicting the end of Uber once the Cybercab rolls out. They’re wrong.

Demand for rides is very spiky. There are big peaks during the morning and evening rush hours. There’s another peak on weekend evenings, when people go out to socialize.

The rest of the time, demand is much lower. But who can afford to buy a ton of Cybercabs and have them sit idle most of the time?

The solution: put Cybercabs on the Uber platform.

Cybercabs, owned by new fleet managers or by Tesla itself, will be available on Uber. You’ll also see self-driving cars owned by individuals who aren’t using them at the moment. And for the foreseeable future, there will be some human drivers too.

Waymo already has its self-driving cars on the Uber app. Tesla will do the same.

I used to think that robotaxis would kill Uber too! Kudos to Bill Gurley for explaining why that won’t be the case.

Legacy Automakers and High Speed Rail Lose

Tesla, Waymo and Uber all win in a world of robotaxis. The biggest losers will be legacy automakers.

The first to hit hard times will be the Big 3 and Volkswagen. With their quality problems and dated technology, who will want their cars anymore?

Next in line are the Japanese. Honda, Toyota and Nissan make better products, but they’re nowhere in the robotaxi race. They will become increasingly irrelevant.

High speed trains are another loser in a self-driving world.

Tokyo Station to Shin-Osaka Station (308 miles) takes 2 hours and 22 minutes on Shinkansen. I’ve taken Shinkansen — it’s a fantastic experience.

Philadelphia 30th Street to Boston South Station is almost the exact same distance (306 miles). On the Acela, America’s fastest train, it takes 5 hours and 12 minutes.

American trains are slow as heck. We know that.

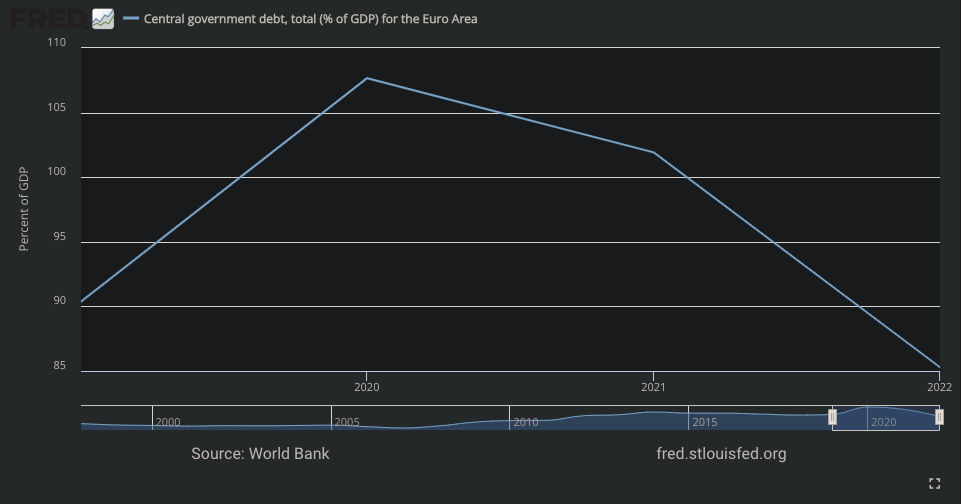

But building bullet trains is incredibly expensive. The recent extension of the Hokkaido Shinkansen is costing about $15 billion at current exchange rates.

And that’s in Japan! I think we all know it’s going to cost a lot more here. The California high speed rail project is projected to cost as much as $128 billion.

Maybe a car takes longer, but if you’re watching Netflix or taking a nap, do you care? And it’s kind of nice to save $128 billion, especially when our country is deeply in debt.

Wrap-Up

“This is a beautiful future, man.”

That’s what Shaul Nakash said when he took the first-ever Cybercab ride with Elon (see the video at the top). I couldn’t agree more.

When I was a kid, we didn’t have a car. My mom was born blind in one eye, which makes driving difficult.

In our tiny town in northern Wisconsin, we were at the mercy of buses that stopped running at 6pm. And no bus on Sundays.

When we couldn’t get a bus, we used a payphone to call the one cab company in town. We had to call over and over to find out where it was. Sometimes, we waited over an hour.

This was a massive pain in the butt. The difference between the world of the 90’s and 2000’s and the world we’ll see this decade is incredible.

I’m just grateful for men like Elon. He’s doing what few people can.

It all comes down to founders.

What do you think of the Cybercab?

More on tech:

Which Jobs Will AI Replace? Which Jobs Are Safe?

Lessons From My 3 Most Challenged Investments

Learning From My Top 3 Investments

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.