Some of the greatest companies in the history of capitalism are selling at ridiculously low prices right now.

How would you like to have Warren Buffett as your personal money manager? Today, he’s available at a discount: just 12 times earnings. And Berkshire isn’t the only blue chip that’s on sale.

Stocks in the Bargain Bin

Trump’s big tariff announcement Wednesday has spooked markets. The S&P 500 is down 10% and markets worldwide are falling in sync.

This is leading to some incredible bargains in stocks.

Let’s take a look at 5 of the best companies in history. Here are their current price/earnings multiples:

Google: 19

Berkshire Hathaway: 12

Merck: 12

Bank of America: 11

Samsung: 11

Google is the greatest money machine ever invented by man. You could easily justify a 25 PE on that.

As for Berkshire and Merck, these are tried and true companies, the bluest of blue chips. They could jump by 50% and still not be overvalued.

This is how tough markets end. You begin to see some ridiculous bargains like these. Then, a few folks tiptoe into the market and scoop them up.

Is the Whole Market Cheap?

Despite the drop since Trump’s tariff announcement, stocks on the whole are not especially cheap. The S&P PE ratio sits at 25, still above the historical average of 15-20 times earnings.

The market is dominated by the Magnificent 7 stocks, many of which are still trading at rich multiples:

Tesla: 113

Nvidia: 32

Amazon: 31

Microsoft: 29

Apple: 29

These stocks have come down, but their prices were so high at the market peak that they’re still expensive. Less fashionable companies, however, are trading at very low valuations.

But What About Tariffs?

Even if the tariffs stay on, the valuations of some stocks are incredibly low. But what if they’re only temporary?

The White House is already beginning negotiations with dozens of countries on lowering tariffs. If our trading partners cut their rates, Trump may cut ours, perhaps all the way down to zero.

Relief on the tariff front would be a massive tailwind for the market.

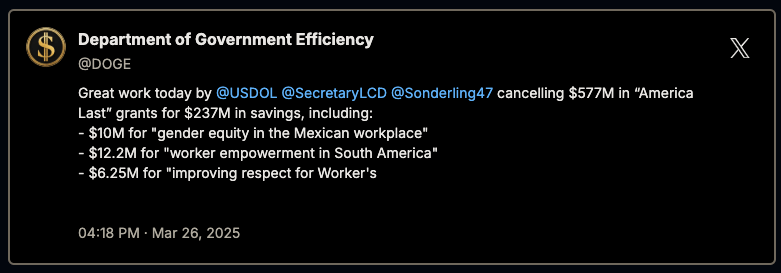

And don’t forget about tax cuts. Congress is working on a major package as we speak. Lower taxes could give markets a significant boost.

Wrap-Up

Investors are manic depressive.

When they’re excited, they bid stock prices too high. When they’re scared, they panic sell and prices fall through the floor.

We’re seeing amazing bargains right now in some of the best companies of all time. I expect buyers to pop up for those companies, supporting the market.

As for me, I’m holding all my positions.

Tariffs or no tariffs, companies will continue to innovate. I intend to own a piece of it.

More on markets:

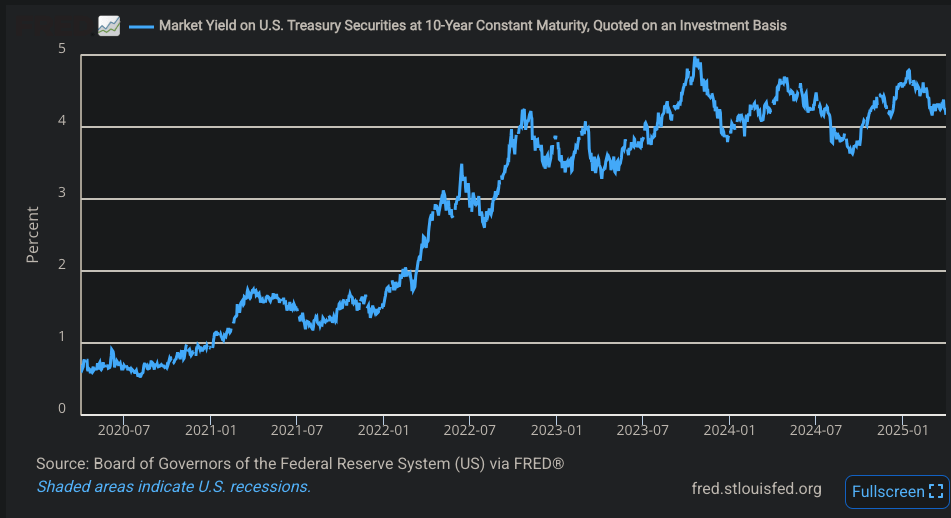

As Tariffs Hit, Lower Interest Rates Could Cushion the Blow

Using Grok 3 to Manage My Stock Portfolio

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.