I don’t invest in 94% of the world. It’s completely unfair and I make no apology.

My goal isn’t to be fair. It’s to make successful investments.

I invest in a handful of countries: the United States, U.K., Canada, Australia, and New Zealand. They represent just 6% of the world’s population.

I chose these countries because they’re very similar to the US in economic development, laws, and culture.

Many US based investors do the same. Here’s why…

The Power of Networks

I’ve been angel investing in the US for almost five years. Bit by bit, people are coming to know me.

If I go to the other side of the world, no one knows me!

There are great startups created in Israel, India, and Africa. But what are the odds I’d meet them?

The best opportunities will go to the local investors. I’ll be stuck with leftovers.

Predictability Goes a Long Way

I know the legal system here in the United States. The systems in places like Canada and the U.K. are similar, all based on British common law.

I don’t know anything about the legal systems in Africa or India. I don’t know anything about their politics or economies.

Political upheaval or currency fluctuations can torpedo an investment. In the well-developed countries where I invest, that’s less of an issue.

Drilling Oil in Oshkosh

The United States has produced the vast majority of highly successful startups. It makes sense to invest here.

Of my 39 investments to date, 35 have been in the U.S. I expect that trend to continue.

If you’re drilling for oil, you don’t go to Oshkosh, Wisconsin, where I grew up. You go to Texas, which has a history of big oil discoveries.

It’s not much different for startups.

Where are you likeliest to find the next Uber or Ramp? Where you found the last ones — SF and New York.

Wrap Up

Making great investments in America is hard enough. Making great investments somewhere radically different is almost impossible.

My best shot is in markets I know with a history of success.

Other countries will continue to produce the occasional great company. But I’ll be sticking to my own back yard.

More on tech:

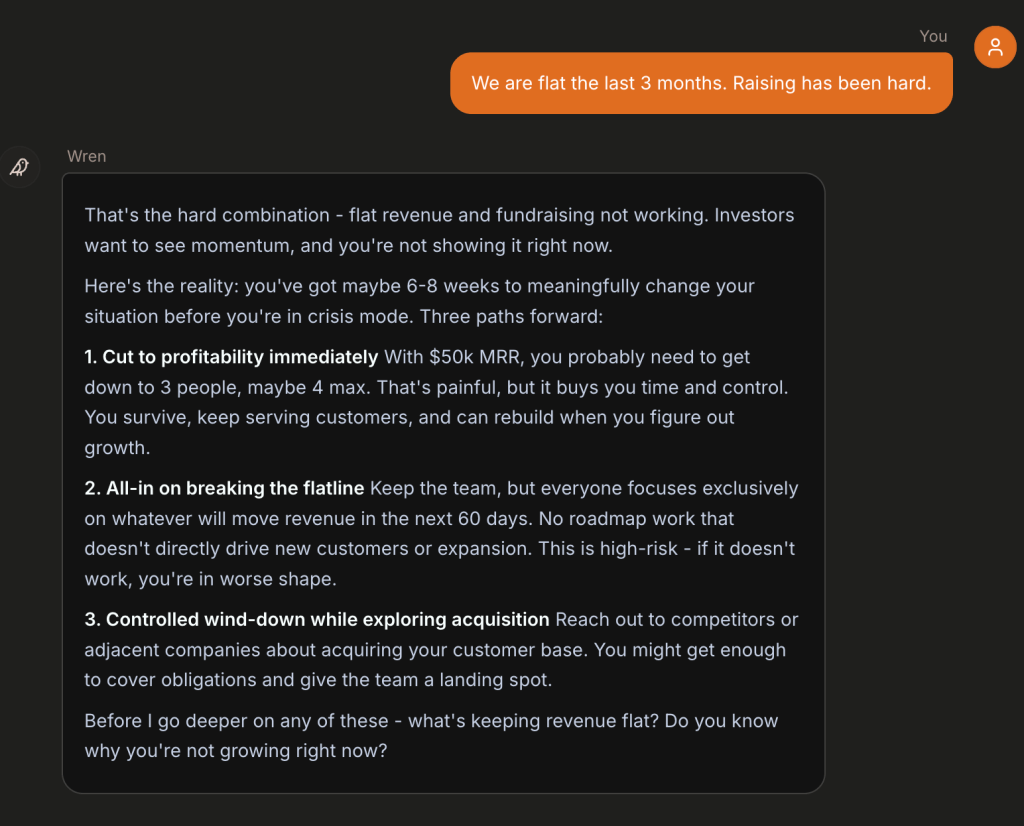

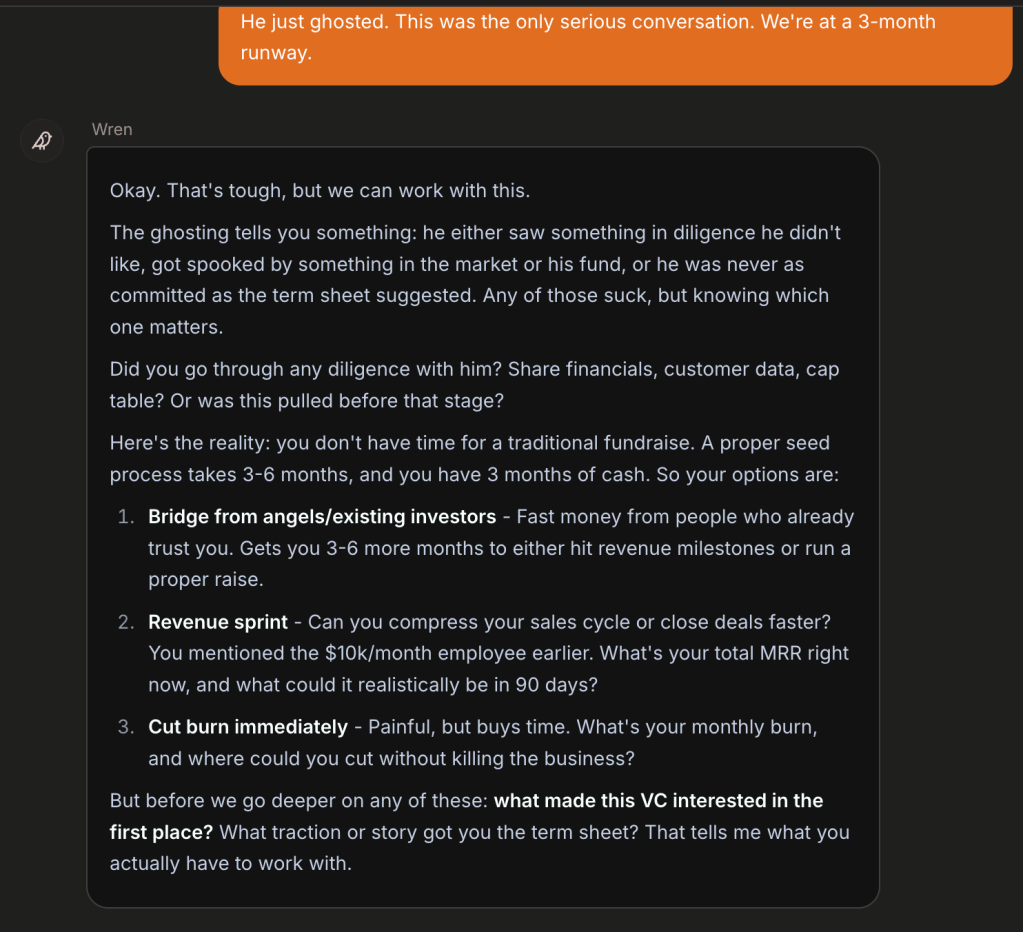

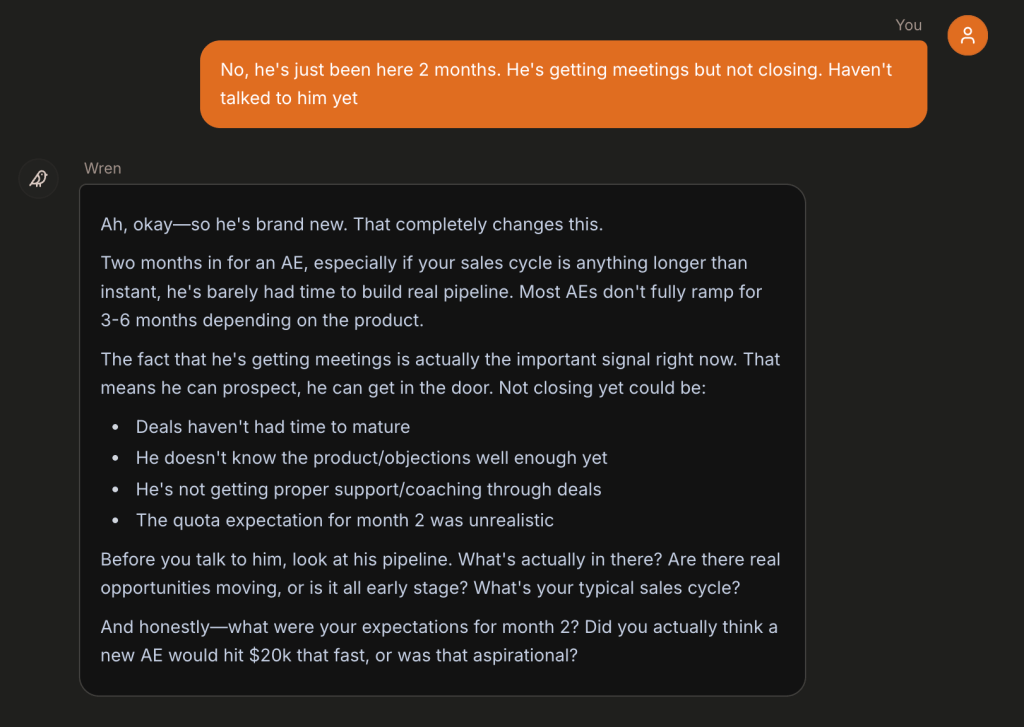

Why the ‘Pretty Good Startup’ Can’t Raise Money Today

Your Deck Probably Sucks. Here’s How to Fix It.

Why You Must Be Full Time to Raise Venture Capital

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.