YC’s X25 batch is in full swing. 94 companies have launched so far. Here are my 3 favorites…

Zeon Systems

I only see a company this exciting a couple times a year, if that.

Zeon Systems is automating scientific research. You type in the experiment you want to do in natural language. Robot arms execute the experiment for you.

This can make every researcher enormously more productive. That means the cost of scientific research falls dramatically.

What happens when you make something cheaper? You get more of it.

More scientific research could cure cancer, heart disease and countless other diseases.

Think about how long it takes to train a scientist. They have to be born, go to kindergarten, elementary, middle and high school. Next comes college, then grad school. Finally, they can make a meaningful contribution to a lab.

You can stand up a new robot in a few hours, if that.

The potential for Zeon is incredible. I have a meeting set with these guys for next month.

Notus Autonomous Systems

Two years ago on the blog, I wrote about how a drone botnet could win the next war. Welp, these guys actually built it.

Notus Autonomous Systems is a drone swarm that operates autonomously to accomplish a mission.

Today, one pilot flies one drone. With Notus, you’ll give the drone swarm a goal and it will act on its own.

Notus’ drones both fly and move over land. They could be a powerful tool to protect America.

These founders are so committed they went to Ukraine to learn about modern war. Any founder willing to do that will stop at nothing to make his company a success.

I just contacted these guys to set up a meeting.

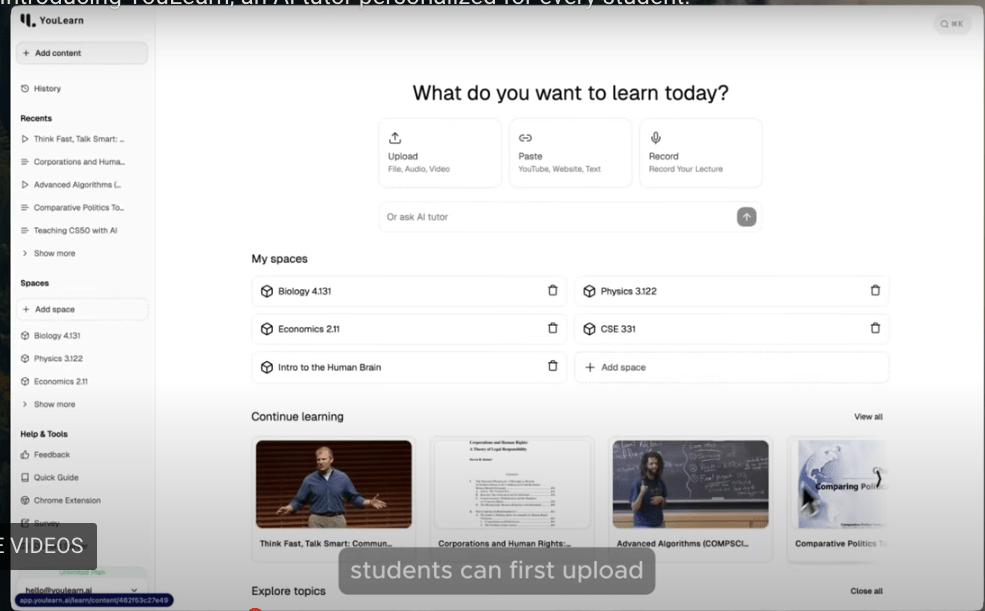

YouLearn

I use AI to teach me things all the time. Recently, I’ve learned about CRISPR and missile defense.

I learn way faster with AI than in most classrooms I’ve been in. So if AI learning works for me, it might work for someone else too, right?

YouLearn is a personal AI tutor. It digests your class notes, quizzes you, and explains concepts you’re struggling with.

I’ve looked at several different AI tutoring startups. YouLearn appears to be catching on faster than anything else I’ve seen.

I just e-mailed these fellas to learn more!

Wrap-Up

Investors love to complain about YC — waah, the valuations!

If you don’t like the price, don’t pay it.

Me, I’m grateful for Y Combinator. Nobody else helps early stage startups more than they do.

I had a great time learning about all these awesome companies. The week of Demo Day, I’ll be back with my top picks from the later YC launches.

What are your favorite companies in the current batch?

More on tech:

My Biggest Lesson from Four Years Angel Investing

The Coolest Startups at ERA Demo Day

Meet My Latest Investment: Sent.dm

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.