China is building bridges with massive robots. Is America hopelessly behind?

This weekend, I heard about China’s bridge building robot on The All-In Podcast. The idea of building a bridge at warp speed with robots intrigued me.

So this morning, I decided to learn more…

The Iron Monster

Many Chinese bridges are built with a massive robot called the SLJ900/32, also known as the Iron Monster. It can move big sections of pre-built bridge into place in a matter of hours.

Looking at the Iron Monster, it’s easy to view America as pathetically behind. We use cranes that take weeks to do what the Iron Monster does in a few hours.

But actually, each country is using the method that best suits its needs.

Is America Behind?

The Iron Monster is great for building the same type of bridge over and over, especially for high speed rail. China is building a ton of bridges right now, so they need that type of construction.

America has been a developed nation for a long time. We already have tons of bridges, so we rarely need to build a new one.

We also have little need for high speed rail. Our country’s population density is low and we have tons of airports.

What’s more, new technologies on the way may make high speed rail obsolete. Self-driving cars and eVTOLs can satisfy the same need at a fraction of the cost.

What we need isn’t a bunch of new bridges. It’s maintenance of the bridges we have. For that, the flexible, crane-based methods we use make more sense.

Wrap-Up

It’s easy to see a viral video out of China and think “Wow, we’re screwed.” It fits the meme that China is way ahead of us.

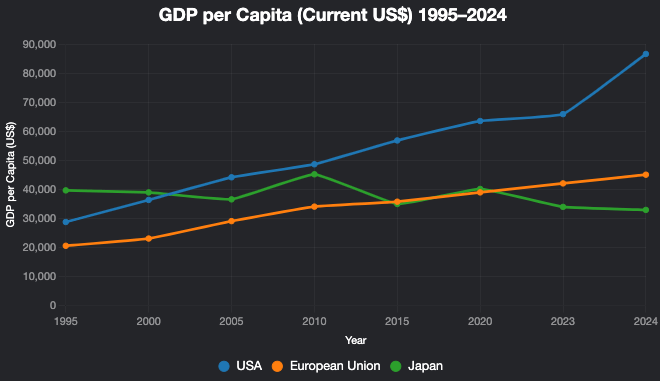

The truth is usually more complicated. There’s a reason America is still much richer than China — we’re doing a lot of things right.

Dig into the facts behind these viral clips. You’ll often find that things aren’t quite what they seem.

Have a great weekend, everybody!

More on tech:

Did a Robot Try to Attack Humans?

Climb, Crawl, Fly, Swim: Jake Loosararian at the All-In Summit

Google Glasses: A Computer for Your Face?

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.