Pat Tillman walked away from a $3.6 million NFL contract to join the Army after 9/11. What makes a man do something like that? As I headed off on vacation a couple of weeks ago, I cracked the book Where Men Win Glory to find out.

Tillman was one of the best defensive players in the NFL at the turn of the millennium. But after the September 11 attacks, he was not content to sit back and let others fight al Qaeda. He decided to enlist himself.

Tillman At War

His base pay as a private in the Army was a long way from his NFL millions: just $1,290 a month. And Tillman put himself in grave danger, requesting an infantry billet.

Tillman served in Iraq briefly but never saw combat. Soon after, he was deployed to Afghanistan.

Sent to patrol remote villages near Afghanistan’s border with Pakistan, Tillman and his unit wound their way up remote mountain passes. As darkness began to fall that night, some of the Rangers in Tillman’s unit mistook him for a Taliban insurgent.

Despite his efforts to signal to them, they shot him dead.

The Cover Up

At first, the military and the White House claimed that Tillman fell bravely resisting the Taliban. This was despite internal reports that he died in friendly fire.

The truth was that Tillman’s death was a colossal screw-up by the military. Another soldier shot him dead at a distance of just 120 feet. It wasn’t even entirely dark when it happened.

Soldiers even destroyed some critical evidence, including burning his uniform, which is against military rules.

In time, the truth came out: Tillman was killed by his own.

His death appears to have been an accident. Chalk it up to the fog of war: nervous men, many of whom had never been in combat, fired wildly and Tillman paid the price.

Why Did Tillman Walk Away From Millions?

Very few people would walk away from fame and millions of dollars to risk their life in Afghanistan. So why did Tillman do it?

Tillman was a man of principle. He didn’t think others should have to fight while he sat on his NFL millions.

But he was also a thrill seeker.

Many times in college, Tillman made dangerous jumps from high cliffs into bodies of water. Some of the jumps could’ve killed him.

I’ve never jumped off a cliff. I’ve also never served in the military.

Principles shape our behavior. But so do more obscure personality traits.

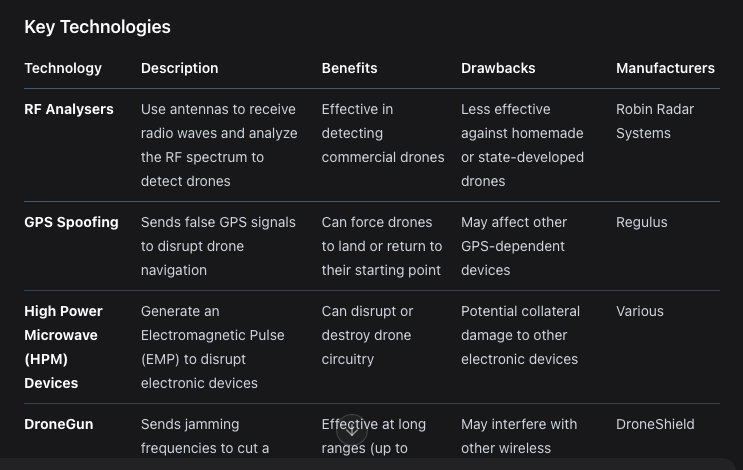

Preventing Friendly Fire: How Startups Can Help

These days, I view a startup as the solution to every problem. And there’s a great startup to be built here.

Sadly, what happened to Tillman is not rare. In Iraq and Afghanistan, the percent of casualties caused by friendly fire reached as high as 41% and 13% respectively.

Nearly half of all casualties, caused by our own forces! This is unacceptable.

Soldiers need a beacon that will broadcast their location and the fact that they’re friendly. Other soldiers could see this in a heads-up display or on a device. We could also put these beacons on friendly vehicles.

This product would save untold lives. If you’re building it, contact me.

Wrap-Up

As I sit here writing this 21 years after Tillman‘s death, the Taliban is back in control of Afghanistan.

Tillman could have stayed home, played football, and enjoyed his family. They would’ve been better off. He would’ve been better off. And the situation in Afghanistan would’ve been no different.

I respect what Tillman did. But I wish he hadn’t done it.

Sometimes, answering the call of duty isn’t the thing to do. Sometimes, we’re better off taking care of our own.

More on books:

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.