What happens when you lower the cost of something? You get more of it. My latest investment, Zeon Systems, is doing that for scientific research.

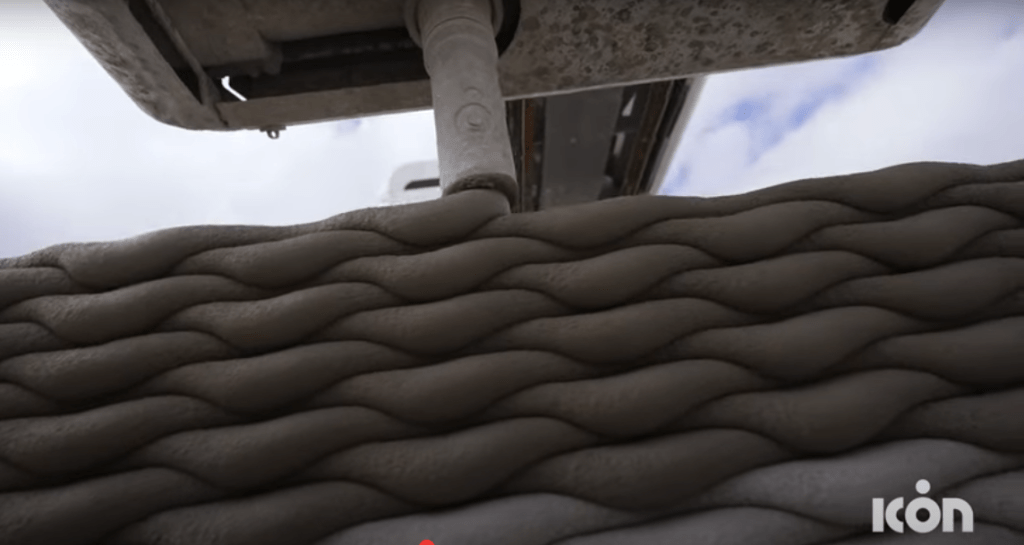

Zeon lets you automate experiments. Just describe the experiment in natural language in a ChatGPT-style text box. Then, the robot arms carry it out!

There are around 1 million research scientists performing experiments in America today. Training a new one takes many years. But building a robotic arm takes just a couple of hours.

I first heard about Zeon on X during its YC launch. I knew immediately that I had to meet these guys.

I cold messaged them the next day and set up a meeting. Frankly, I’d have met them at 3am on a Tuesday if that’s what they wanted.

You have to be aggressive when you see a great investment. There are only a few really special startups per year.

When I met with Founder & CEO Brontë Kolar recently, I was struck by how much she cares about this problem.

She was researching antibiotic resistance with her co-founder Tahir D’Mello after their workdays at Latch Bio. When they realized that it would take years to begin to crack the problem, they knew they needed to automate the lab work.

So they founded Zeon.

I want a future with hundreds of millions of Zeon robotic arms, all conducting experiments 24/7. Powerful AI models will direct them to the most important research problems.

If we can do that, all the dominoes will fall: cancer, heart disease, dementia, you name it. Eternal health, eternal life.

Not a bad vision for a startup.

Check out Zeon and get your lab running 24/7!

More on tech:

My Favorite Startups in YC X25 (Part 1)

Meet My Latest Investment: Sent.dm

My Biggest Lesson from Four Years Angel Investing

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.