The startup world has a million metrics. CAC, LTV, ROAS. But here are 3 key metrics many founders aren’t looking at…

Burn Multiple

How do you know if the money you’re burning is producing any results? You won’t, unless you calculate your burn multiple.

Here’s how to do it…

Burn Multiple = (Last Month’s Net Burn) / (This Month’s ARR – Last Month’s ARR)

Let’s say you burned $100,000 last month. Your ARR right now is $200,000. Last month it was $150,000.

That’s $100,000/$50,000, or a burn multiple of 2. That’s solid for an early stage startup.

I compute this number for every investment I make. When I see burn multiples below 2 in early stage companies, I get excited.

These guys are capital efficient!

User Engagement

User engagement stats aren’t just for social media companies. One of the best predictors of churn is a customer not using your product.

If they’re not using it, sooner or later they’re going to go through their credit card statement and cancel. You want to prevent that.

If you’re selling a B2B product, a customer should be using it most business days.

Aim for 3 days a week minimum. Tools like Mixpanel or Amplitude can find this information for you.

If a customer isn’t using your product, find out why. Are they not getting value from it? How can you improve?

Those customer interviews are a treasure trove of information.

Runway

This is a simple one. But I cannot tell you how many founders ignore it. I’ve seen companies get down to a few months runway then desperately run out to raise money.

Sometimes it works. Sometimes it doesn’t.

So how do the pros do it?

Take Rahul Vohra at Superhuman. He maintained 48 months runway at all times.

This gave him options, through good markets and bad. And while many companies that raised big bucks in 2021 died during the down market, Rahul was able to get Superhuman to a juicy acquisition by Grammarly this month!

Wrap-Up

One of the great things about having so many successful startups is that you can derive a formula for success.

No company can be reduced entirely to metrics. But if you’re capital efficient, have lots of cash on the balance sheet, and customers are relying on your product every day, you’re on the right track.

What metrics do you track as a founder or investor?

More on tech:

Have You Seen These Valuations Lately?

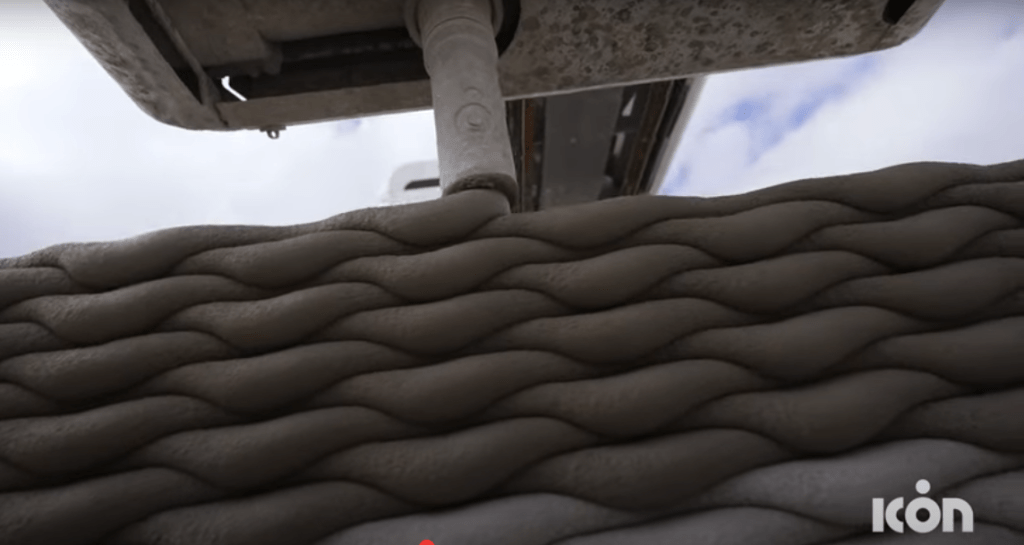

Housing Prices Are Ridiculous. Can Startups Help?

Are Hackers After Your Brain? — The Rise of CogSec

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.