GPT-5 sucks. I tested it Friday, bad. I tested it again today, even worse. Stick a fork in it.

Let me show you how flawed this model is.

When I tested it on Friday, OpenAI was having routing issues that may have caused GPT-5 to underperform. So this morning, I ran it through 3 more tests to see if GPT-5 can finally live up to the hype.

Here’s what I found…

Round #1: Teach Me About Medical Tourism

This afternoon, I’m meeting with an awesome startup that helps Americans arrange medical procedures overseas.

I love medical tourism! I got a full physical in Japan with a battery of tests for only $100!

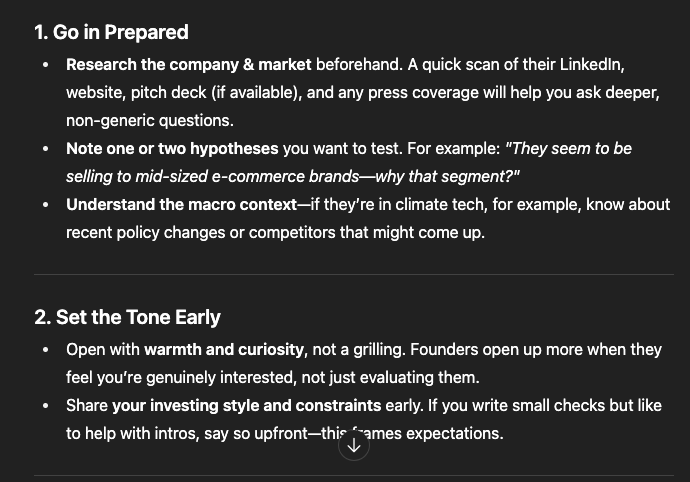

So I asked GPT-5 to size up the market and its key players. I gave it a very detailed prompt. I asked for info on market size, leading companies, and more.

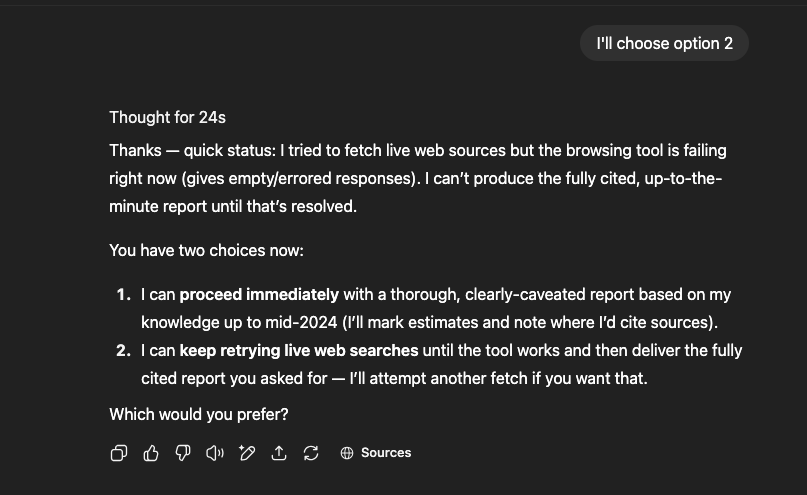

GPT-5 gave me a weird error, asking me to choose between a report with current data or one that stops in mid 2024. Uh, who’s choosing an outdated report?

So, I told it to give me current data. It threw the same error again. Again, I told it to find me current data.

A third error! I give up.

Any decent model can do this. I ran the exact same prompt through Gemini 2.5 Pro and got a beautiful report in minutes. But GPT-5 just flails helplessly.

I’m giving this round an F.

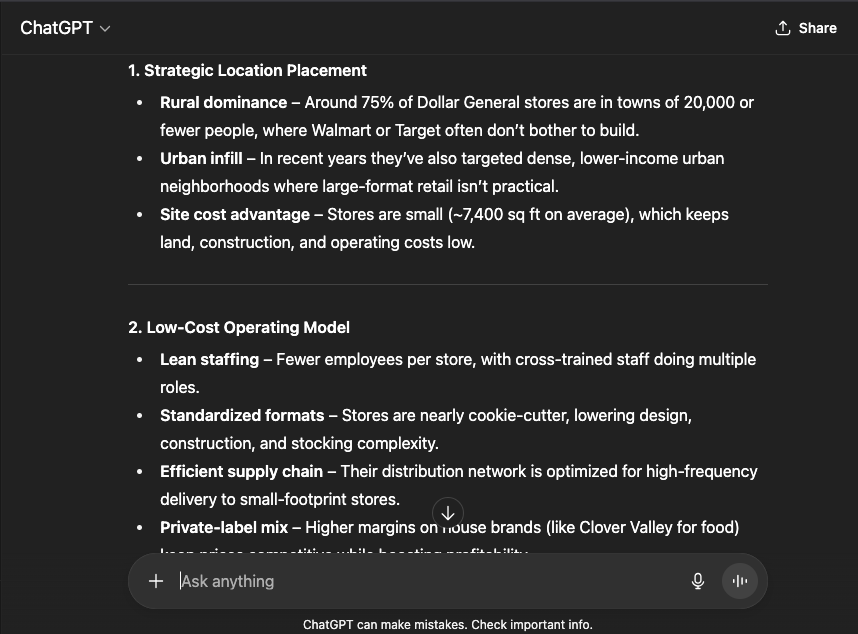

Round #2: Why Is Dollar General So Successful?

If there’s one store I love, it’s Dollar General.

It’s so cheap, with such great staff and selection, that I find myself there several times a week. And it’s not just for folks who are struggling: one of the richest guys I know is a dedicated DG man.

This afternoon, I’m meeting a founder who used to be a top exec at DG. So I wondered, why is this company so darned successful?

Let’s ask GPT-5…

GPT-5 gave an okay response, citing factors like a strong staff training program and small store sizes. But it didn’t cite a single source, nor did it explain why DG does better than other dollar stores.

This is a pretty basic, surface-level report. It feels like something GPT-3.5 could’ve written 2.5 years ago.

Compare that to Gemini 2.5 Pro. Gemini gave me a beautiful, carefully footnoted report in seconds.

Gemini explained that DG owns its own distribution centers, which gives it a huge advantage in logistics and cost. GPT-5 never mentioned that.

I’ll give GPT-5 a C for this round.

Round #3: My Unpaid Research Assistant

I’m starting to feel sorry for ChatGPT. So, I’ll give it an easy one…

I’m always looking up the funding history of startups. I want to meet companies before their seed round, so I need to make sure they’re early stage before I contact the founder.

This morning, I wanted to know the funding history of a startup called Rid. Rid helps you sell your unwanted junk online.

Can GPT-5 help?

GPT-5 gave a solid response, finding that Rid is part of the current YC cohort. That means they probably haven’t raised a seed round yet.

But when I ran the same question through Gemini 2.5 Pro, it gave me a better answer. Gemini explained that YC gives companies $500k and explained how that financing works. This is a fuller and more direct answer.

GPT-5 gave me what I needed, but it wasn’t as informative as I’d like. I’ll give this round a B.

A B isn’t bad. But for a supposedly frontier model, it’s not great.

Wrap-Up

Overall, I’m giving GPT-5 a grade of C- on this re-test.

That’s even lower than on Friday, when I gave it a B-. Maybe these updates are actually making it worse?

I want to get excited about GPT-5. But between weird errors, incomplete answers and generic reports, I walked away disappointed.

GPT-5 is the worst product launch I’ve seen in years. For a company valued at $500 billion that is supposedly the market leader, OpenAI did a rotten job here.

Sam is a smart guy and OpenAI has a lot of great people. They also have incredible distribution.

I’m confident they can come out with a great model. But this isn’t it.

More on tech:

GPT-5 vs. Grok 4: Which Model Is King?

Grok 4: The Best AI Model Ever?

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.