Note: This is not investment advice.

“Have fun being poor!” I’m pretty sure someone is going to say that in the comments. But to invest in Bitcoin, I need a reason. Let me run through why the possible reasons to own Bitcoin don’t hold up.

A Store of Value — Gold

There will only ever be 21 million Bitcoin. This fixed supply leads many holders to treat it like digital gold.

But why not just buy actual gold?

Both are assets with a largely fixed supply. Gold, however, has been recognized as a store of value for over 6,000 years. Bitcoin has only existed for 16.

And if storing bullion is a little too much work, there are gold ETF’s that hold physical gold and regularly have auditors verify their stores.

Me Want Yield!

Gold is a better established store of value than Bitcoin. But neither one comes with an income stream.

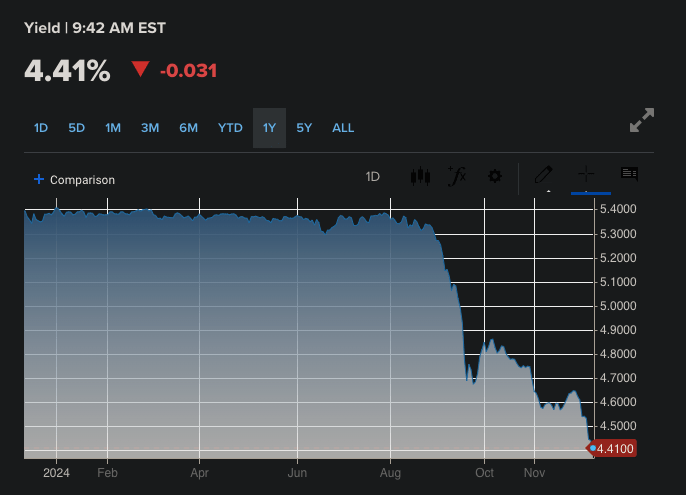

If I wanted safety, Treasury bills would be a good alternative. They’re backed by the US government and pay interest.

Today, 1 month Treasury bills yield 4.4%. Even if you think the US government will go bust, I doubt it will happen in the next month.

DeFi platforms have offered some yield on cryptocurrencies. But they have a habit of turning out to be scams — see the recent conviction of the founder of Celsius.

An Inflation Hedge With a Yummy Income Stream

I like gold and Treasuries more than Bitcoin. But I actually have $0 in any of these three asset classes.

For a store of value and inflation hedge, I like real estate.

A house is a house, whether prices go up or down. It is likely to retain its value, since someone can live in it.

Real estate comes with a tasty income stream. In multifamily, that averages around 6%. In industrial or retail, it can go even higher.

The risk owning real estate is definitely higher than a Treasury bill. That suits my risk tolerance, but may not suit yours.

What’s Left — Speculation

If Bitcoin isn’t the best store of value and has no income stream, what is it for? Speculation, pure and simple.

People buy Bitcoin because they think it will go up. Most people’s rationale is no more complicated than that.

The problem is, it’s very hard to make money speculating. It comes down to a quote from Benjamin Graham:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

When we buy an asset because it’s popular, rather than because it has intrinsic value, we tend to lose big. Asset prices have a way of reverting to their real value over time.

Wrap-Up

I don’t see value in Bitcoin. And the correct allocation to an asset that lacks value isn’t 10%, 5%, or even 1% — it’s zero.

Seeing the price at nearly $100,000, who doesn’t wish they’d bought at a dollar, right? But chasing yesterday’s gains won’t make me money.

Maybe you own Bitcoin. And maybe I’m wrong and it goes to $10 million. Then you’ll make a fortune, and I won’t.

If so, I’ll be happy for you! It’s not taking anything away from me.

What do you think of Bitcoin?

Note: This is not investment advice.

More on tech:

Lessons From My 3 Most Challenged Investments

Leave a comment