I paid $6.79 for 18 eggs recently. No wonder the consumer is in trouble.

For fortunate people like me, inflation is just an annoyance. But for people of modest means, it’s a crisis.

“How long can people keep going like this?” I wondered. So this morning, I dug into some data…

Falling Behind

Americans are falling behind on credit cards and auto loans. Balances 90+ days delinquent have jumped significantly since 2023.

Some of the wildest stories are coming out of the auto market. People bought cars for above sticker price during COVID and now owe more on the cars than they’re worth. This creates a debt spiral.

The Struggling Working Class

Americans as a whole have reported worsening finances since 2021. But the biggest drops in financial health are among people with a high school diploma or some college but no more.

In other words, the working class.

Before inflation, many working class people were getting by and perhaps able to save a modest sum. Now, with prices through the roof, they’re being pushed into the lower class.

A Two-Track Society

Why are things going well for people like me, but not for blue collar Americans? It all comes down to the money supply.

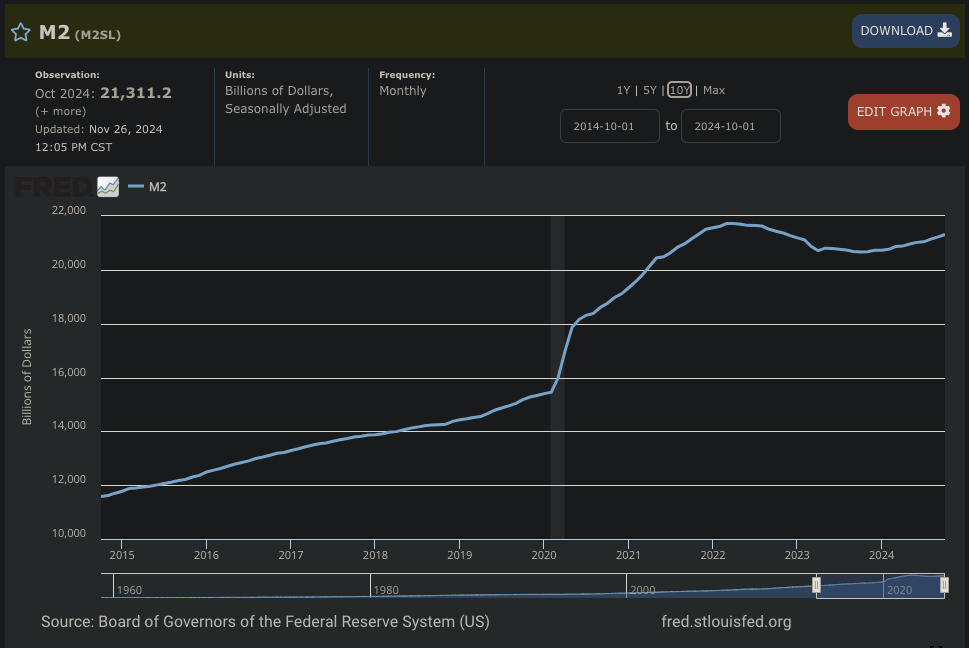

The government has increased the money supply by 38% since the beginning of COVID. This money has chased two things: assets and goods.

The price of both are through the roof. But the higher asset prices primarily benefit the well-off, while the rising prices for goods crush the working class.

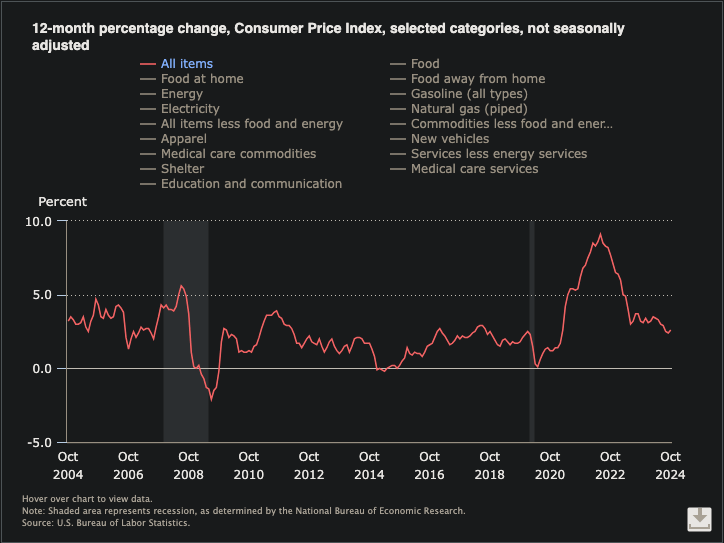

Inflation is beginning to fall, which should make things a little easier for the working class. But prices are still over 20% higher than before COVID, and that’s not likely to change.

Regardless of what you think of the man, is it any wonder Trump won given these stats?

What This Means for Businesses

For those of us who run and invest in businesses, financial stress among consumers is a serious problem. If you sell your product to the working class, sales are probably getting harder.

Take Buy Now Pay Later (BNPL) providers like Affirm or Klarna, for example.

Consumers who use BNPL are poorer than average. I expect BNPL delinquencies to rise just as credit card delinquencies have.

Wrap-Up

It’s a hard time for working class Americans. While fortunate people like me benefit from an asset bubble, blue collar folks struggle to pay their bills.

Declining inflation will help the average man. But it’s going to take a long time to make up what they’ve lost.

Are you seeing more people struggle financially?

More from the blog:

Which Jobs Will AI Replace? Which Jobs Are Safe?

Why Manufactured Housing Won’t Fix High Housing Costs

Lessons From My 3 Most Challenged Investments

Save Money on Stuff I Use:

This platform lets me diversify my real estate investments so I’m not too exposed to any one market. I’ve invested since 2018 with great returns.

More on Fundrise in this post.

If you decide to invest in Fundrise, you can use this link to get $100 in free bonus shares!

I’ve used Misfits for years, and it never disappoints! Every fruit and vegetable is organic, super fresh, and packed with flavor!

I wrote a detailed review of Misfits here.

Use this link to sign up and you’ll save $15 on your first order.

Leave a comment